Table of Contents

Top 5 Products to Import from India in 2025:

Introduction: India’s Moment in Global Trade

India is solidifying its position as a global manufacturing and export powerhouse. Driven by strategic government initiatives like the Production-Linked Incentive (PLI) schemes, massive infrastructure investments, and the geopolitical momentum of the “China Plus One” sourcing strategy, India’s total exports are projected to maintain strong growth, aiming for a total trade figure surpassing $$$825 billion in the financial year 2024-2025.

For international importers, distributors, and bulk buyers, 2025 represents a critical window to diversify supply chains and capitalize on high-quality, competitively priced products. The export landscape is no longer dominated by traditional commodities; it is now defined by high-value, high-tech, and specialized goods.

Below is an in-depth analysis of the top 5 product categories offering the most lucrative import opportunities from India in 2025.

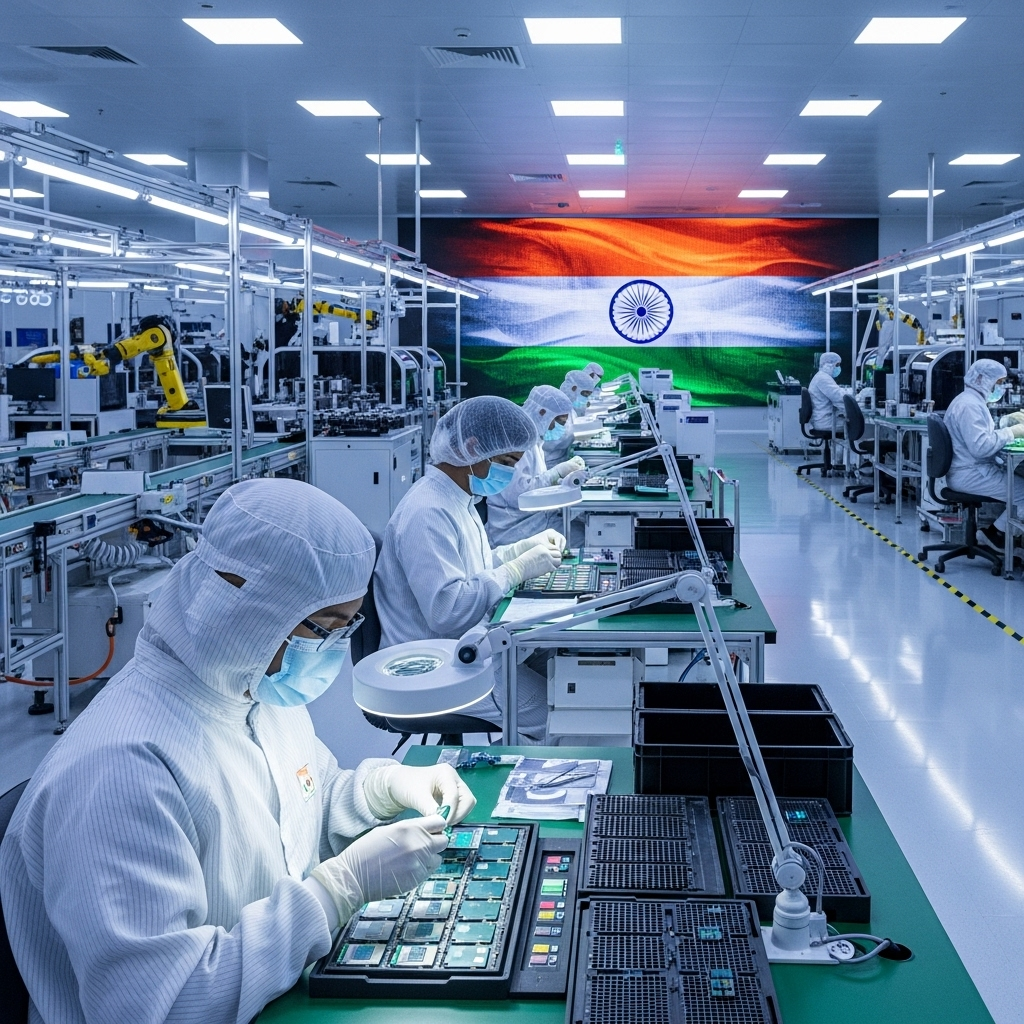

1. The New King: Electronic Goods and Components

The most dramatic shift in India’s export portfolio is the meteoric rise of Electronic Goods and Components, particularly smartphones.

The Opportunity:

- High Growth: The electronic goods sector is India’s fastest-growing export category, with outward shipments soaring by over 32% in the last financial year (FY2024-25), reaching an export value exceeding $$$38.5 billion.

- Smartphones and IT Hardware: Manufacturers are scaling up production to meet global demand, making India a global hub for smartphone, laptop, and server component manufacturing. The focus is now shifting from simply assembling to manufacturing higher-value components like chargers, batteries, and display units.

- Diversification of Components: Beyond finished goods, the market for imported Indian-made electronic accessories, printed circuit boards (PCBs), LED components, and low-cost consumer gadgets is booming, driven by global brands diversifying their component sourcing away from singular geographies.

Actionable Insight for Importers: Focus on sourcing in bulk from PLI-beneficiary companies. Look for sub-categories like mobile phone accessories, wearables, and basic networking hardware, where Indian MSMEs are showing increasing sophistication and cost-competitiveness.

2. The Reliable Giant: Drugs & Pharmaceuticals (Generics and APIs)

India has long been known as the “Pharmacy of the World,” a title it continues to uphold and strengthen in 2025. The COVID-19 pandemic and subsequent global supply chain disruptions reinforced the critical role of India’s generic drug and vaccine manufacturing capabilities.

The Opportunity:

- Global Health Imperative: With an export value over $$$30 billion in FY2024-25 and a consistent growth rate of nearly 10%, Indian pharmaceuticals offer reliable, high-quality, and cost-effective generic medicines, Active Pharmaceutical Ingredients (APIs), and formulations to over 200 countries.

- Focus on APIs: Government policies are encouraging domestic manufacturing of APIs and Key Starting Materials (KSMs), reducing reliance on imports for raw materials. This ensures greater stability and cost control for the finished product, benefiting international buyers looking for long-term supply security.

- Specialized Areas: Exporters are diversifying into complex generics, biosimilars, and herbal/Ayurvedic formulations that are gaining traction in Western markets due to growing interest in holistic wellness and natural ingredients.

Actionable Insight for Importers: For pharmaceutical importers, look beyond finished medicines to specialized APIs and bulk drugs. Ensure your supplier has stringent regulatory compliance, including US FDA, European GMP, and WHO-GMP certifications, as quality is non-negotiable in this sector.

3. Engineering and High-Grade Construction Materials

The “Engineering Goods” segment is India’s largest export category by volume and value, exceeding $$$116 billion in FY2024-25. This vast sector includes a high-potential sub-segment that is crucial for global infrastructure and real estate development: High-Grade Construction Materials.

The Opportunity:

- Global Infrastructure Boom: As developing nations expand their infrastructure and mature markets face housing crises, the demand for cost-efficient, certified, and durable building materials is at an all-time high.

- Steel, Cement, and Reinforcement: India is a major exporter of high-quality Iron and Steel products, including TMT (Thermo-Mechanically Treated) steel bars and structural steel, which are fundamental to all major construction projects.

- Modern Building Solutions: Beyond traditional materials, Indian manufacturers, particularly in clusters like Gujarat, are leading in the production of modern, sustainable building materials. Examples include:

- AAC (Autoclaved Aerated Concrete) Blocks and Fly Ash Bricks: Lightweight, eco-friendly, and highly durable alternatives to traditional bricks, now widely accepted globally.

- GFRP (Glass Fiber Reinforced Polymer) Rebar: A revolutionary non-corrosive alternative to steel reinforcement, ideal for coastal, marine, and highly corrosive industrial environments.

- Ceramic Tiles and Sanitaryware: The Morbi cluster in Gujarat, for example, is one of the world’s largest ceramic manufacturing hubs, exporting high-end tiles and sanitaryware globally.

Actionable Insight for Importers: This category offers incredible scale and margin. Importers should directly engage manufacturers who offer a complete suite of building solutions (e.g., blocks, joining mortar, and reinforcement). The competitive pricing from Indian manufacturers in this sector makes it a strategic import for international real estate developers and wholesalers.

4. Specialty Spices and Certified Organic Food Products

India’s agricultural heritage provides a continuous, high-margin export opportunity, particularly in the niche of certified organic and specialty food products.

The Opportunity:

- Global Wellness Trend: The market for organic, natural, and plant-based foods is exploding globally. Importers are seeking authenticity and high-potency ingredients.

- High-Value Spices: India is the world’s largest exporter of spices. High-value varieties like high-curcumin Turmeric, aromatic Cumin, and specialty Chilli powders are commanding premium prices internationally, driven by their medicinal and health benefits. The sector saw over $$$4.45 billion in exports recently.

- Certified Organic Products: Exports of certified organic products (including organic cotton, cereals, and herbal teas) have seen a growth spike of over 34%. Global buyers value Indian certifications like NPOP (National Programme for Organic Production), which align with USDA Organic and EU Organic standards.

Actionable Insight for Importers: Look beyond bulk commodities. Focus on niche, high-margin items like organic rice varieties, customized spice blends, value-added products (like single-estate coffees or specialty teas), and herbal supplements. Prioritize suppliers with transparent traceability and international organic certifications.

5. Sustainable Textiles and Apparel

Textiles and ready-made garments (RMG) remain a core strength of India’s exports, with the sector showing renewed growth as global brands seek ethical and sustainable alternatives.

The Opportunity:

- Sustainability Focus: The global fashion industry is moving toward sustainable, transparent supply chains. India’s strong cotton, jute, and silk production, coupled with a growing number of sustainable fabric manufacturers, provides a distinct advantage.

- Traditional Craftsmanship (Handicrafts): Indian handcrafted apparel, unique handloom fabrics, block-printed textiles, and specialized leather goods are in high demand in the US, UK, and European boutique markets. This sub-sector allows smaller importers to enter with unique, higher-margin products.

- High-Growth Apparel: The exports of ready-made garments of all textiles saw a notable growth of over 10% in the last fiscal year, reflecting a strong global recovery in demand for Indian fashion and casual wear.

Actionable Insight for Importers: Target suppliers that can provide certified sustainable fabrics (e.g., GOTS-certified organic cotton) and ethically produced items. This aligns with modern consumer values and allows for premium retail positioning.

Conclusion

The data confirms that India’s export landscape in 2025 is characterized by diversification, high-value addition, and resilience. The government’s focused strategy, which includes an emphasis on technology (Electronics) and key manufacturing sectors (Engineering/Construction), coupled with its traditional strengths in pharmaceuticals and agriculture, offers a robust and balanced supply chain alternative for global importers.

Importers looking to succeed in 2025 must focus on these high-growth, high-potential sectors. Sourcing from India today is not just about cost-reduction; it’s about securing a reliable, high-quality, and future-proof supply chain partner.

[…] to support and empower the skilled artisan communities who preserve this ancient craft. For importers looking for products rich in tradition and uncompromising in quality, Tyrix Domin Impex is the newly certified, ethical […]