Table of Contents

The week of December 7 to December 13, 2025, in the Logistics and Shipping sector was dominated by strategic policy advancements in India aimed at radically reducing costs and boosting efficiency. Globally, the market wrestled with geopolitical risk and volatile freight rates.

For The Exporter Hub members, these domestic reforms are crucial: reducing the high cost of logistics (currently impacting MSMEs severely) is the most direct way to boost the competitiveness of Indian goods in global markets.

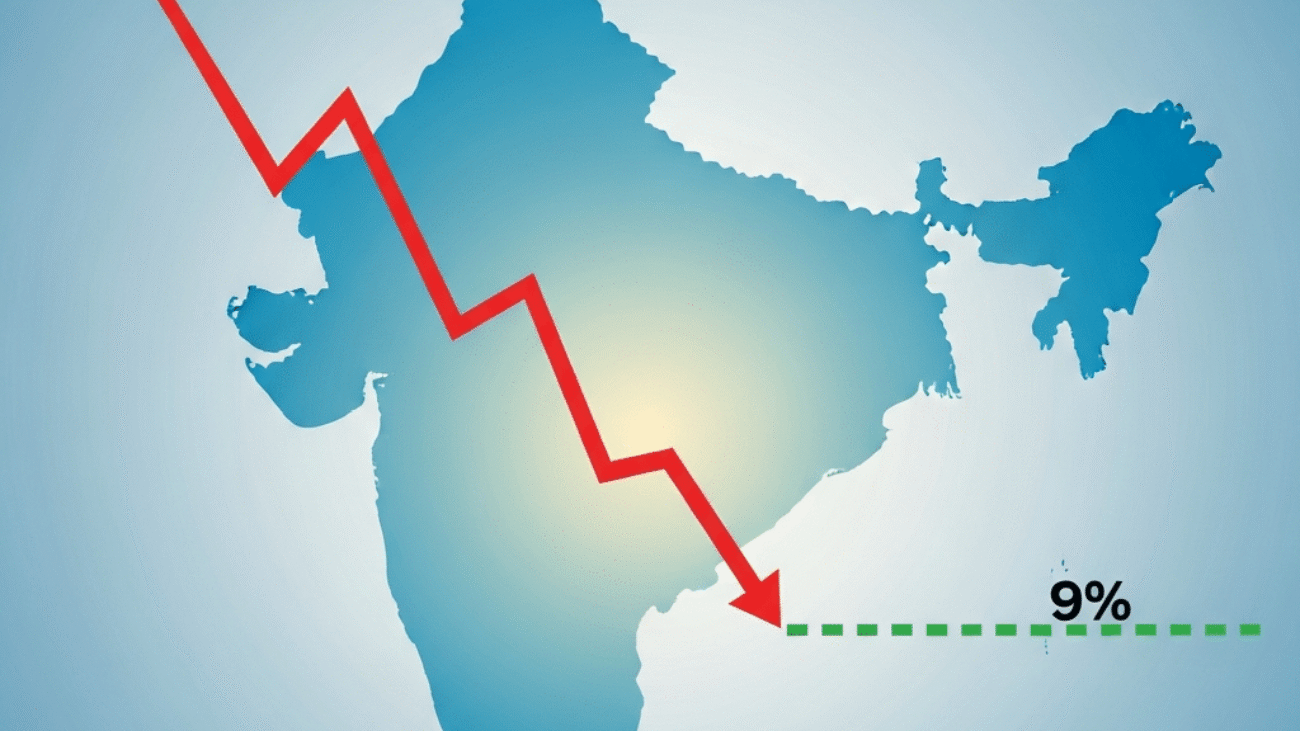

1. 🇮🇳 India Targets Sub-10% Logistics Cost by Year-End $\text{2025}$

A major focus this week was on the final push by the Indian government to achieve its long-standing target of bringing national logistics costs down to 9% of GDP by the end of December 2025.

- Crucial Target: Union Minister Nitin Gadkari emphasized that the government is closing in on this goal. Achieving this sub-10% cost is a cornerstone of the National Logistics Policy and is essential for aligning India with global benchmarks (8% to 10% in developed nations).

- Impact on MSMEs: Studies indicate that the logistics cost for the MSME sector (which forms the core of The Exporter Hub‘s clientele) stands at a massive 16.9% of GDP. Halving this cost via infrastructure upgrades and digital integration is expected to drastically improve profitability and export margins.

- The Mechanism: This reduction is being driven by the convergence of major infrastructure projects: the PM Gati Shakti program, the development of Multi-Modal Logistics Parks (MMLPs), and the increasing use of Dedicated Freight Corridors (DFCs) by the Indian Railways, all of which are designed to enhance multimodal connectivity.

2. 🏛️ Indian Ports Act 2025 Comes into Focus: Modernizing the Maritime Sector

With the logistics push gathering speed, stakeholders continued to analyze the significant impact of the Indian Ports Act, 2025—a landmark legislation replacing the century-old 1908 Act.

- Statutory Reforms: The new Act provides a modern, unified legal structure for port development, strengthening the statutory roles of State Maritime Boards and the Maritime State Development Council (MSDC). This institutionalizes coordination between the Centre and coastal states, crucial for integrated port development (which includes ports in Gujarat).

- Boosting Efficiency and EODB: Key provisions include:

- Digitalisation: Promoting the Maritime Single Window system for paperless, streamlined clearance.

- Tariff Transparency: Introducing a new tariff regulation mechanism with mandatory electronic publication for all ports, enhancing transparency and predictability for exporters.

- Sustainability: Mandating Global Green Norms and environmental safeguards, bringing Indian ports in line with international maritime practices.

- Strategic Importance: As ports handle nearly 95 % of India’s EXIM cargo by volume, this legislation is positioned to transform them from simple transit hubs into catalysts for economic growth and global competitiveness.

3. 🚢 Ocean Freight: Capacity Glut and Red Sea Uncertainty Drive Volatility

Globally, the ocean freight market remained highly volatile, driven by capacity changes and persistent geopolitical risk in the Middle East.

- Suez Canal/Red Sea Status: Major carriers like Maersk announced they were moving closer to resuming transits through the Suez Canal under new strategic security agreements. However, other carriers like Hapag-Lloyd remained cautious. A full resumption would shorten Asia-Europe transit times by 10 to 14 days, but a sudden influx of ships could lead to port congestion and short-term rate instability.

- Rate Fluctuation: The Drewry World Container Index (WCI) rose slightly (2 % to $1,957 per 40ft container) driven by a tactical surge on the Asia-Europe lane. Conversely, Transpacific rates (Asia-US) declined again, due to weak post-peak season demand and aggressive blank sailings by carriers failing to stabilize prices.

- Overcapacity Risk: The long-term structural issue of overcapacity persists, with the global container fleet order book remaining at an historical high (about $ 30 of the existing fleet). This ensures that carriers will face downward pressure on rates throughout 2026, barring major unforeseen geopolitical events.

4. ✈️ Air Cargo Surges on E-commerce and AI Demand

The air freight market showed resilience and strategic growth in key trade lanes, often driven by high-value, time-sensitive cargo.

- Rate Recovery: Global airfreight rates, as measured by the Baltic Air Freight Index (BAI), continued to rise into early December, with particularly strong gains on the busiest lanes out of China to Europe and the US.

- Structural Drivers: This growth is fueled by:

- E-commerce: A structural shift to smaller, more frequent replenishments drives demand for air cargo.

- AI and Tech: Growing demand for high-value, time-sensitive goods related to Artificial Intelligence (AI) and advanced electronics continues to be a major tailwind for air cargo volumes.

Source : vajiramandravi.com