US Removes 5 Key Tariffs on Indian Spices and Tea

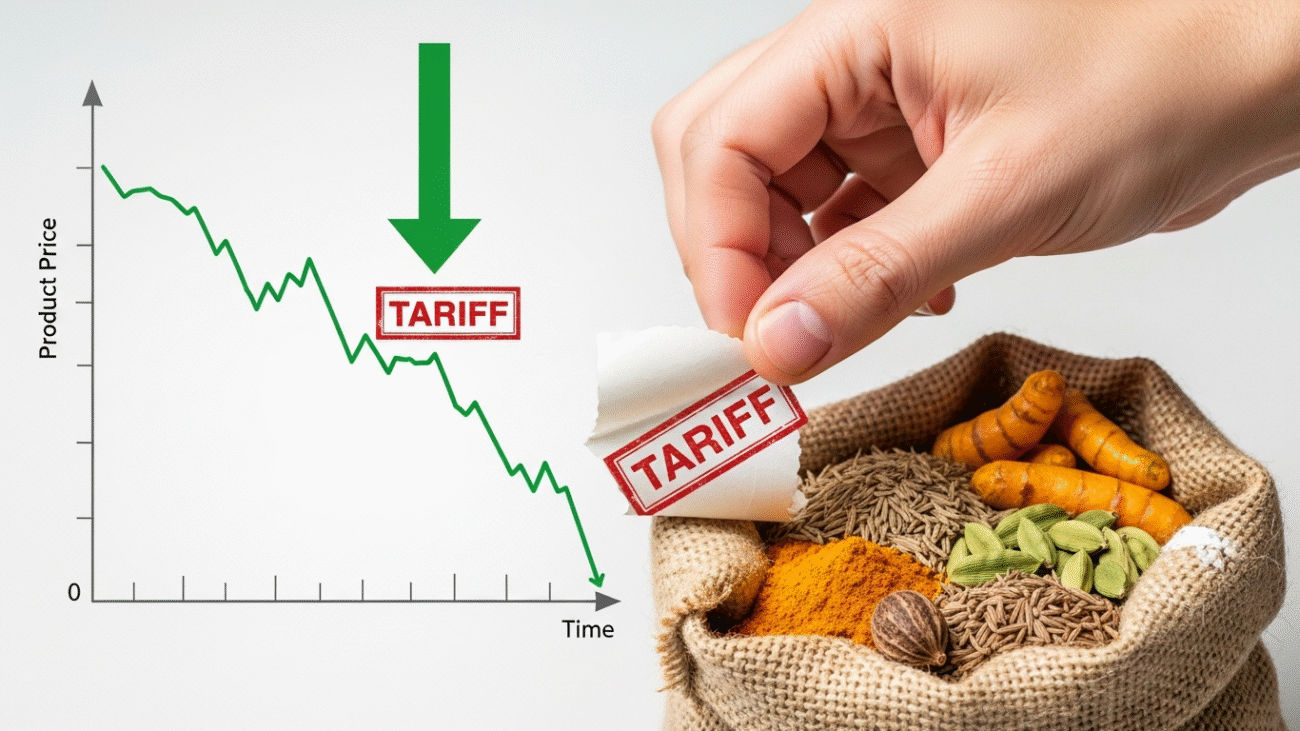

The recent action by the U.S. government to remove tariffs on certain Indian goods, particularly some agricultural products, is a significant positive step in the trade relationship between the two countries. This move makes it easier and cheaper for Indian exporters—and platforms like The Exporter Hub—to sell products in the American market.

Here is a simple explanation of what this means, focusing on the core concept of a tariff and the benefits of its removal.

Part 1: What is a Tariff? (The Simple Definition)

Imagine you live in India and you want to buy a high-quality television made in the U.S.

-

Definition: A tariff (or a duty) is simply a tax imposed by a government on imported goods and services.

-

The Goal: Governments primarily use tariffs for two reasons:

-

To Raise Revenue: The money collected from the tax goes to the government.

-

To Protect Domestic Industries: By making imported goods more expensive, the government encourages consumers to buy cheaper products made domestically.6 This protects local companies from foreign competition.

-

How Tariffs Work (A Simple Example):

| Product | U.S. Price | Tariff Rate | Final Price to Buyer |

| Indian Spices | $100 (Cost to Import) | 25% Tariff | $125 (The buyer/consumer pays the extra $25) |

In this example, the 25% tariff adds an extra cost, making the Indian spices more expensive than similar spices produced in the U.S. or imported from a country without this tariff.

Part 2: The Recent US Executive Order Explained (November 2025)

On November 14, 2025, the U.S. President signed an Executive Order that removed the existing “reciprocal tariffs” on a list of specific agricultural and food products, including:

-

Spices (like pepper, cumin, ginger)

-

Tea and Coffee

-

Tropical Fruits and Juices

-

Certain Fertilizers (crucial for farming)9

Why did the U.S. Remove These Tariffs?

-

Domestic Pressure: A major reason cited by the White House was growing pressure from U.S. consumers and industry groups over high grocery prices (inflation). Since many of these exempted products (like tropical fruits and tea) are not produced in large quantities in the U.S., the tariff was only hurting consumers by raising the cost of items they couldn’t buy domestically.

-

Trade Negotiations: The move is also a positive diplomatic gesture, signaling progress in the broader, ongoing trade discussions between the U.S. and India to eventually resolve all outstanding tariff disputes.

Part 3: The Benefits of Tariff Removal for India

The removal of these tariffs is a win for both the Indian exporter and the U.S.-India trade relationship:

| Beneficiary | Benefit of Tariff Removal | How it Works |

| 1. Indian Exporters (e.g., Tea, Spices) | Increased Price Competitiveness | With the tariff gone, Indian goods immediately become cheaper for U.S. buyers. This makes Indian products competitive against those from countries like China or Vietnam, helping exporters (and The Exporter Hub users) sell higher volumes and potentially revive market demand that was lost due to the high tariff. |

| 2. U.S. Consumers | Lower Prices and More Choice | The tax is removed, so the final cost of a product like Indian tea or spices goes down for the American shopper. They save money and get access to a wider variety of specialized, high-quality products. |

| 3. India-U.S. Trade Relationship | Positive Momentum | This action creates a level playing field for Indian exports in these specific categories and is seen as a major step toward resolving the much larger tariff disputes (like the high penalty tariffs on non-agricultural goods). It builds trust and political momentum for a comprehensive trade deal. |

While the immediate financial gain for India is focused on these specific agricultural sectors (spices and tea being the largest beneficiaries), the gesture provides a much-needed lifeline and a strong signal of optimism for the future of trade cooperation.

Source : Investing.com

Add a Comment