The week of November 16-22, 2025, delivered a major shockwave to the Indian financial and foreign exchange (Forex) markets. The Indian Rupee (₹) suffered its largest weekly fall in months, shattering previous record lows as the Reserve Bank of India (RBI) unexpectedly shifted its intervention strategy. This domestic volatility was compounded by the release of minutes from the US Federal Reserve’s meeting, which revealed deep divisions over the future path of US interest rates.

1. 🚨 The Rupee’s Record Plunge and RBI’s Strategic Shift

The Indian Rupee closed the week at an all-time low against the US Dollar ($\text{\$}$), a move that stunned market participants, particularly importers, and immediately boosted the competitiveness of exporters like The Exporter Hub.

-

Psychological Barrier Shattered: The USD/INR pair surged past the psychologically and technically significant $\text{₹}89.00$ mark, hitting an intraday low of $\text{₹}89.59$ on Friday, November 21. This represents a significant depreciation from the levels the RBI had been defending.

-

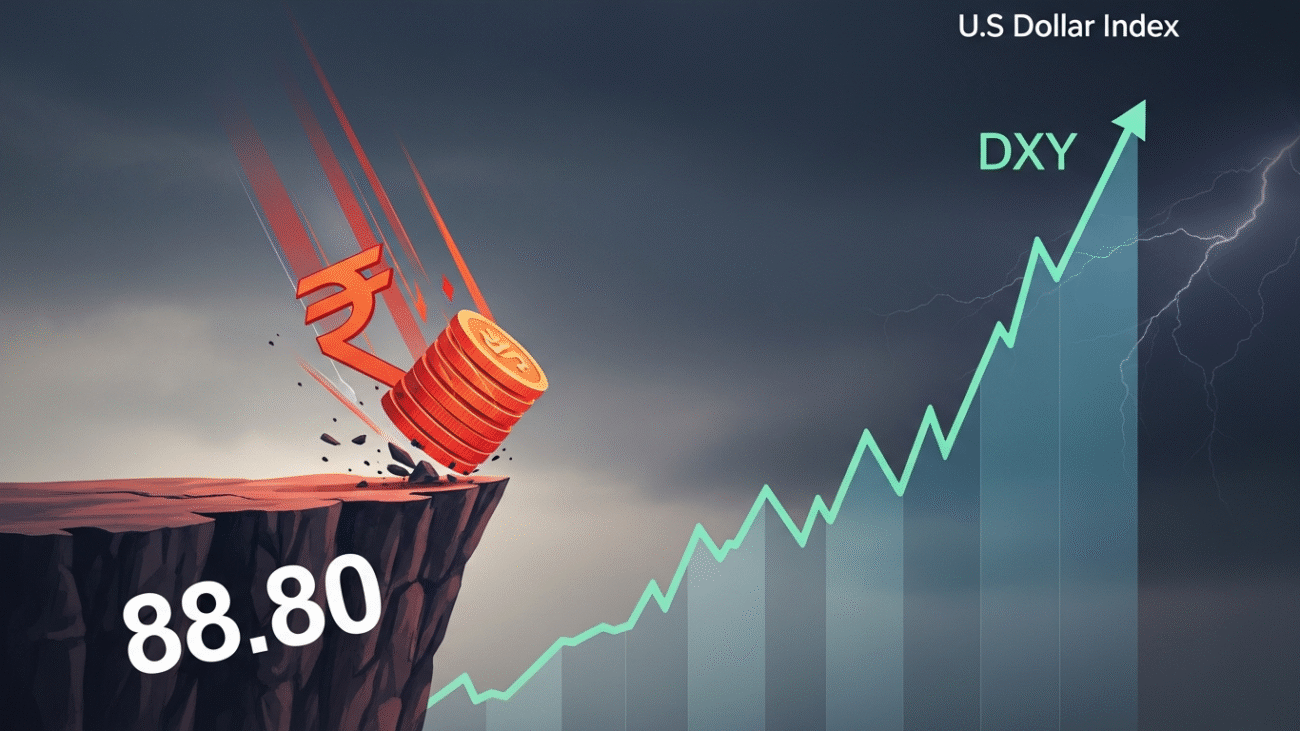

The RBI Intervention Policy Change: The main trigger for the dramatic plunge was the absence of expected RBI intervention at the critical $\text{₹}88.80$ level. The RBI had consistently defended this mark since late September. The sudden decision to step back, allowing the market to find its own level, signaled a change in the central bank’s strategy.

-

Market Miscalculation: Traders had placed stop-loss orders just above $\text{₹}88.80$, betting on the RBI’s continued defense. When the currency broke through that point without intervention, a snowball effect of aggressive dollar buying and short covering (buying dollars to close out bets that the dollar would fall) accelerated the Rupee’s decline by nearly $\text{₹}0.80$ in a single trading session.

-

-

Key Drivers of Rupee Weakness:

-

FPI Outflows: Foreign Portfolio Investors (FPIs) continued to withdraw capital from Indian equities, with over $16.5 billion pulled out year-to-date.

-

Record Trade Deficit: The merchandise trade deficit widened to a record high of $41.7 billion in October (released this week), substantially higher than the $\text{\$32.2}$ billion in September, increasing the demand for dollars to fund imports.

-

Geopolitical and Trade Uncertainty: Lingering uncertainty over the finalization of the India-US trade deal and reports of sanctions on an Indian entity also weighed on market sentiment.

-

For Indian exporters, a weaker Rupee translates to higher Rupee earnings on every dollar of export, making Indian goods, including building materials from Shiv’s Assets Group, more competitive internationally. Importers, however, face severely rising input costs.

2. 🇺🇸 US Federal Reserve Minutes Reveal Deep Policy Split

The minutes from the US Federal Open Market Committee (FOMC) meeting in late October (released this week) revealed significant disagreement among policymakers over the future direction of US interest rates, injecting global uncertainty into the Forex market.

-

Deep Divisions: The minutes highlighted “strongly differing views” regarding the appropriate decision for the upcoming December rate meeting.

-

Split on December Cut: While the FOMC agreed to the second rate cut of the year in October (to the 3.75%-4.0% range), members were deeply divided on a potential December cut. A significant contingent expressed discomfort with another rate reduction due to persistently above-target inflation, even as others prioritized addressing the “downside risks to employment.”

-

Impact on Dollar (DXY): This mixed signal—where the December cut is no longer a certainty—led to a strengthening of the US Dollar Index (DXY), which breached the crucial 100 mark. A stronger dollar globally naturally exerts more pressure on emerging market currencies, including the Rupee.

-

Data Scarcity: The lack of complete October and November jobs data, due to earlier government disruptions, has made the Fed’s decision-making more reliant on a partial economic picture, adding to the general market nervousness.

3. 📈 Global Equities: AI and Technology Drive Divergence

Global stock markets showed divergence, with US indices (driven by the technology sector) continuing to outperform broader international markets.

-

AI-Driven Valuations: US equities remained buoyed by the Artificial Intelligence (AI) boom, which is driving trillions of dollars in capital investment into data centers and related infrastructure. However, analysts are noting increasing “nervousness” regarding the massive valuations of AI-linked companies, pointing out that corporate revenues may not yet justify the capital expenditure surge.

-

Emerging Market Outlook: India remains a “bright spot” among Emerging Markets (EMs), benefiting from continued supply chain diversification away from China and strong domestic demand. Despite the FPI outflows, the underlying corporate earnings strength and policy support for sectors like infrastructure keep the long-term outlook positive.

Source : financialexpress.com

Add a Comment