Railways Cuts Freight Price: 4 Logistics Shocks for Exporters

The Logistics & Shipping sector in India experienced a week of transformative, domestic policy shifts aimed at reducing costs and bolstering global connectivity. The highlight was a major overhaul of freight pricing by Indian Railways, designed to dramatically lower transport costs for building materials (a key sector for the user’s business, Shiv’s Assets Group). Simultaneously, a major Indian port operator announced a strategic international acquisition, solidifying India’s global logistics ambition.

1. 🇮🇳 Indian Railways’ Mega-Reform: Flat $\text{₹}0.90$ Freight Rate for Cement

In a move described as a “game changer” for the construction sector and the Indian middle-class, Indian Railways announced a major reform to the pricing of bulk cement transportation on November 19, 2025.

-

Flat Rate Introduction: Indian Railways has implemented a uniform, flat freight rate of $\text{₹}0.90$ per tonne per kilometre (GTKM) for the transportation of bulk cement in specialized tank containers.

-

Abolishing Slabs: This new simplified structure completely removes the complex, variable distance and weight-based slabs that previously made rail transport unviable or unpredictable for many cement manufacturers, especially those engaged in shorter haulage (under $\text{300}$ km).

-

Direct Cost Benefit: For manufacturers of building materials and the construction sector (which uses products like AAC Fly Ash Block and Joining Mortar), this translates to a substantial reduction in logistics costs. By simplifying pricing and promoting the high-volume, pollution-free movement of bulk cement, the policy is expected to:

-

Lower Final Product Prices: The Railway Minister stated the reform will directly reduce the market price of cement, offering relief to middle-class families building homes.

-

Boost Rail Modal Share: The target is to increase the Railways’ share of bulk cement movement from a mere $\text{7}$ Million Tonnes (MT) currently toward a long-term goal of $\text{30\%}$ by 2030.

-

Promote Multimodal Efficiency: The policy strongly encourages the use of ISO-standard 20-ft tank containers built under the ‘Make in India’ initiative, ensuring seamless, fast, and end-to-end multimodal logistics (road-to-rail and vice-versa) without product repacking or spillage.

-

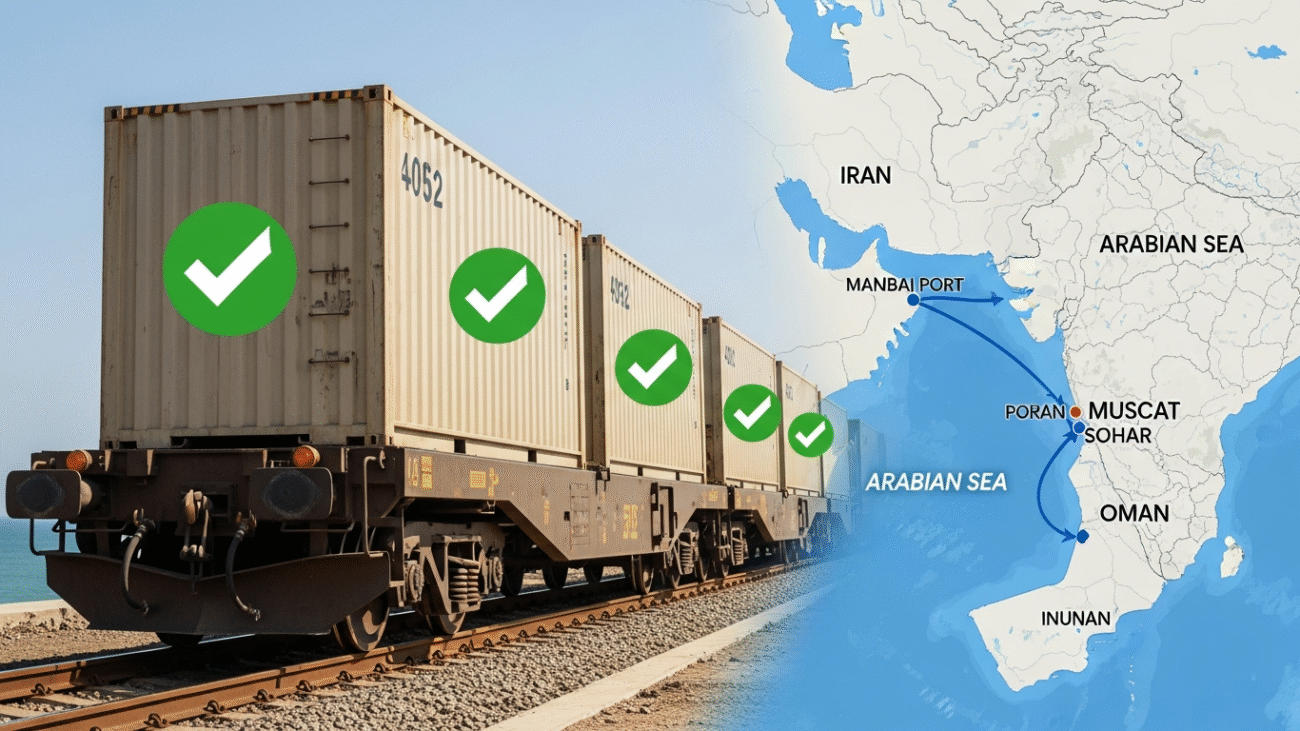

2. 🌍 JSW Infrastructure Acquires Majority Stake in Oman Port

In a crucial step toward securing raw material supply chains and expanding India’s maritime influence, JSW Infrastructure Limited, a major Indian port operator, announced the acquisition of a $\text{51\%}$ majority stake in a new port development project in the Sultanate of Oman on November 17, 2025.

-

Strategic Location: The project, located in the Dhofar Governorate of Oman, involves developing a new $\text{27}$ Million Tonnes Per Annum (MTPA) greenfield bulk minerals port with an estimated capital expenditure of $\text{US\$419}$ million.

-

India-Oman Trade Bridge: JSW is partnering with Minerals Development Oman (MDO), the state-owned mining and minerals investment arm. The port will primarily handle the export of bulk minerals—such as limestone, gypsum, and dolomite—which are critical inputs for India’s steel and cement industries.

-

Supply Chain Security: This investment is highly strategic for Indian manufacturers and importers, including those in the user’s business who deal in Natural Sand and TMT Bars (which rely on steel and cement production). By securing a dedicated port facility in a crucial Gulf nation, JSW is directly strengthening the supply chain efficiency and regional connectivity for essential industrial raw materials. The investment aligns with JSW’s ambitious goal of reaching $\text{400}$ MTPA cargo handling capacity by $\text{2030}$.

3. 📈 Global Container Rates: Transpacific Falls, Asia-Europe Rises

The global ocean freight market during the week continued its pattern of volatility, driven by carrier capacity management rather than genuine demand recovery.

-

Diverging Rates: The Drewry World Container Index (WCI) remained stable overall, but this masked diverging trends:

-

Transpacific Headhaul: Rates from Shanghai to US West Coast continued their slight decline, falling by approximately $\text{7\%}$ for a $\text{40}$ft container, primarily due to cautious consumer spending in the US.

-

Asia-Europe Routes: Conversely, spot rates from Shanghai to North Europe and the Mediterranean saw an increase (up to $\text{8\%}$ in some lanes), as carriers successfully enforced General Rate Increases (GRIs) and capacity restrictions (blank sailings).

-

-

Key Insight for Exporters: This divergence requires Indian exporters to remain highly vigilant. While overall indices might seem stable, the specific trade lane to which they ship (e.g., EU for the user’s group, The Exporter Hub) may be experiencing upward price pressure due to carrier strategies to protect profit margins by restricting vessel supply.

4. 💻 Digitization and Cold Chain Focus in India

The week also saw significant developments in digitizing the Indian logistics network and preparing for future growth in specialized areas.

-

Digital Integration: The state of Andhra Pradesh signed a Memorandum of Understanding (MoU) to integrate its entire logistics ecosystem with the national Unified Logistics Interface Platform (ULIP). This will enable real-time visibility, faster customs clearance, and seamless data exchange across different transport modes—a massive boost to efficiency for Bharuch, Gujarat-based companies.

-

Industry Showcase: The India Warehousing & Logistics Show (IWLS) and the India Cold Chain Show (ICCS) took place in Mumbai (Nov $\text{20-22, 2025}$), focusing on the need for modern, automated warehousing, especially in the pharma, food, and e-commerce sectors, cementing the move towards specialized, high-tech logistics infrastructure.

Source : republicworld.com

Add a Comment