India Secures 10% LPG Imports: 4 Commodity Market Shocks

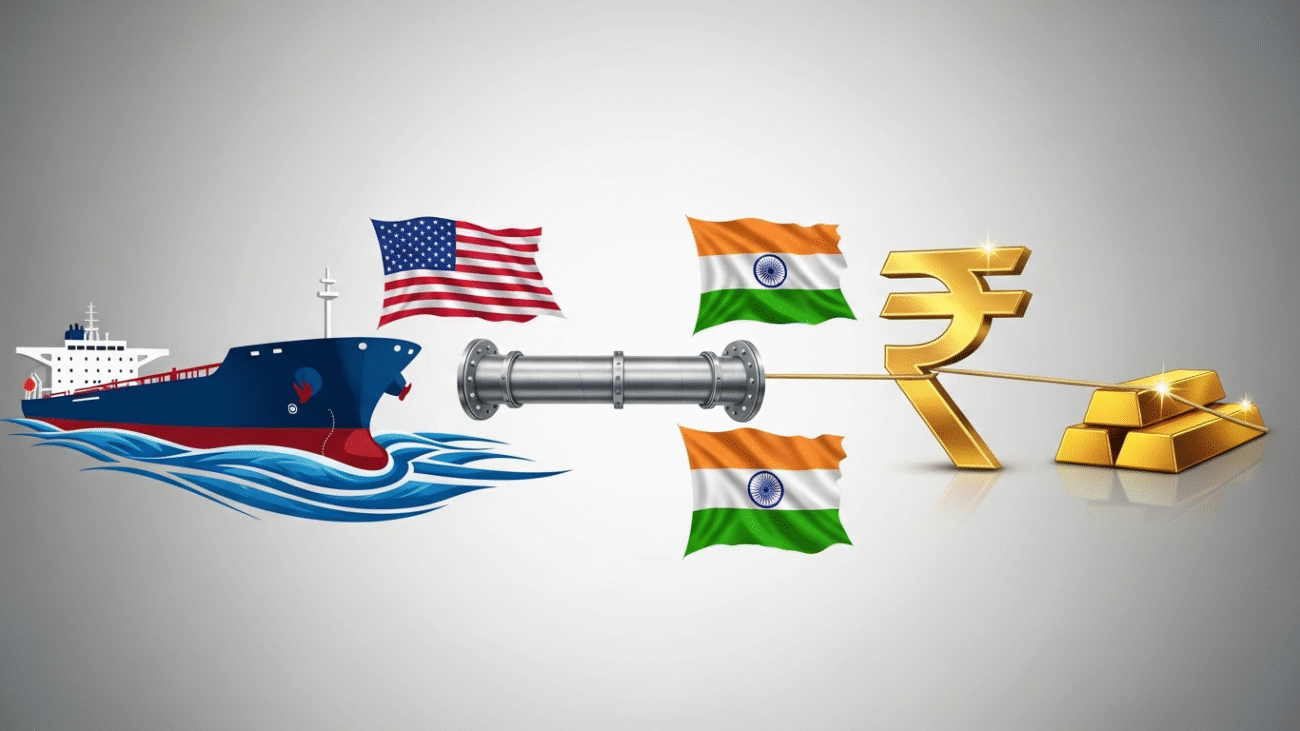

The raw material and commodity markets during the week of November 16-22, 2025, were driven by two powerful forces: India’s strategic moves to secure critical energy supplies and global uncertainty surrounding the US Federal Reserve’s monetary policy. This dynamic environment impacts the cost and availability of essential inputs for industries ranging from manufacturing to construction.

1. 🇮🇳⛽ US-India Strategic Energy Deal: A Game Changer for LPG

In a landmark development set to redefine India’s energy security and significantly impact the domestic industrial sector, India finalized a massive long-term agreement for Liquefied Petroleum Gas (LPG) supply from the United States.

-

Mega-Deal Details: On November 20, 2025, a consortium of three major Indian Public Sector Undertaking (PSU) oil companies (likely IOC, BPCL, and HPCL) inked a deal to purchase 2.5 million tonnes (MT) of LPG annually from the United States.

-

Significant Volume: This quantity represents approximately $\text{10\%}$ of India’s projected LPG import requirements for 2026, making it a cornerstone of the nation’s energy procurement strategy.

-

Strategic Rationale:

-

Diversification: The deal significantly diversifies India’s LPG import basket, reducing its reliance on traditional Middle Eastern suppliers and enhancing energy security.

-

Price Stability: Long-term contracts like this typically offer more predictable pricing mechanisms, shielding Indian consumers and industries from the extreme volatility of spot market prices. This is crucial for sectors that rely on LPG as a fuel source, from industrial burners to commercial kitchens.

-

US-India Trade Relations: The agreement also serves as a critical component in the broader India-US trade relationship, balancing the trade deficit and strengthening economic ties as both nations work towards a comprehensive Bilateral Trade Agreement.

-

-

Impact on Indian Businesses: For businesses involved in manufacturing, a stable and predictable supply of LPG at potentially more favorable prices translates into greater operational certainty and potentially lower energy costs, contributing to overall competitiveness.

2. 💰 Gold’s Volatility: Waiting on the Fed’s Next Move

Gold prices remained highly volatile this week, driven primarily by market anticipation and speculation surrounding the US Federal Reserve’s upcoming monetary policy decisions.

-

Price Fluctuations: After a brief dip early in the week, Gold futures (on both COMEX and MCX) rebounded, hovering around the $\text{\$2,000}$ per ounce mark. This volatility reflects the market’s uncertainty regarding the likelihood and timing of future US interest rate cuts.

-

Key Drivers:

-

Fed’s Stance: The minutes from the recent Federal Open Market Committee (FOMC) meeting (released this week) revealed deep divisions among policymakers regarding the December rate cut. This mixed signal created a “holding pattern” for gold, as investors awaited clearer guidance on the Fed’s inflation and employment outlook.

-

Dollar Strength: The US Dollar Index (DXY) remained firm, putting some downward pressure on gold. However, the underlying geopolitical uncertainties and the persistent (though debated) inflation risks continued to support gold’s appeal as a safe-haven asset.

-

Indian Market: On the Multi Commodity Exchange (MCX), gold futures saw a volatile session, reacting to global cues. Demand in the physical market was cautious, as buyers awaited further price stability.

-

3. 🛢️ Crude Oil: Downward Pressure Persists, Year-End Target at $\text{\$57}$

The global crude oil market continued its downward trend this week, extending the losses seen in prior weeks, with analysts now projecting further significant price drops.

-

Price Action: Brent Crude futures dipped further, trading around the $\text{\$61}$–$\text{\$62}$ per barrel range.

-

Bearish Forecasts: Industry analysts, including those at Goldman Sachs, reiterated their bearish outlook, predicting that Brent crude could fall to $\text{\$57}$ per barrel by the end of 2025.

-

Key Factors Driving the Decline:

-

Supply Glut: Persistent oversupply from non-OPEC+ producers (especially the US shale sector) continues to outpace demand growth.

-

Global Demand Concerns: While the US-China trade truce has stabilized some demand expectations, concerns about broader global economic growth, particularly from Europe and China, continue to weigh on the market.

-

OPEC+ Compliance: Speculation about OPEC+’s compliance with its production cuts remains a factor, with some analysts believing the cartel may need to announce deeper cuts to prop up prices.

-

-

Impact on India: As a major oil importer, falling crude prices are a significant economic boon for India. Lower crude costs directly reduce the import bill, help curb inflation (a key focus for the RBI), and alleviate pressure on the Rupee, benefiting both manufacturers and consumers.

4. 🏗️ Indian Construction Materials: Stable Demand, Future Growth

The Indian domestic market for construction materials, including steel, cement, and aggregates, continued to show stable demand and strong growth prospects, supported by government infrastructure spending.

-

Steel Stability: Despite global commodity shifts, domestic steel prices remained relatively stable, underpinned by robust demand from infrastructure projects and real estate.

-

Cement Outlook: Following the significant Q2 results and the GST rate cut, the cement sector remains in expansion mode, with long-term capacity additions projected to meet sustained growth.

-

Fly Ash & M-Sand: The push for sustainable building materials like AAC Fly Ash Blocks and Manufactured Sand (M-sand) continued, driven by government policies and environmental mandates, ensuring a stable supply of these critical inputs.

Source : business-standard.com

Add a Comment