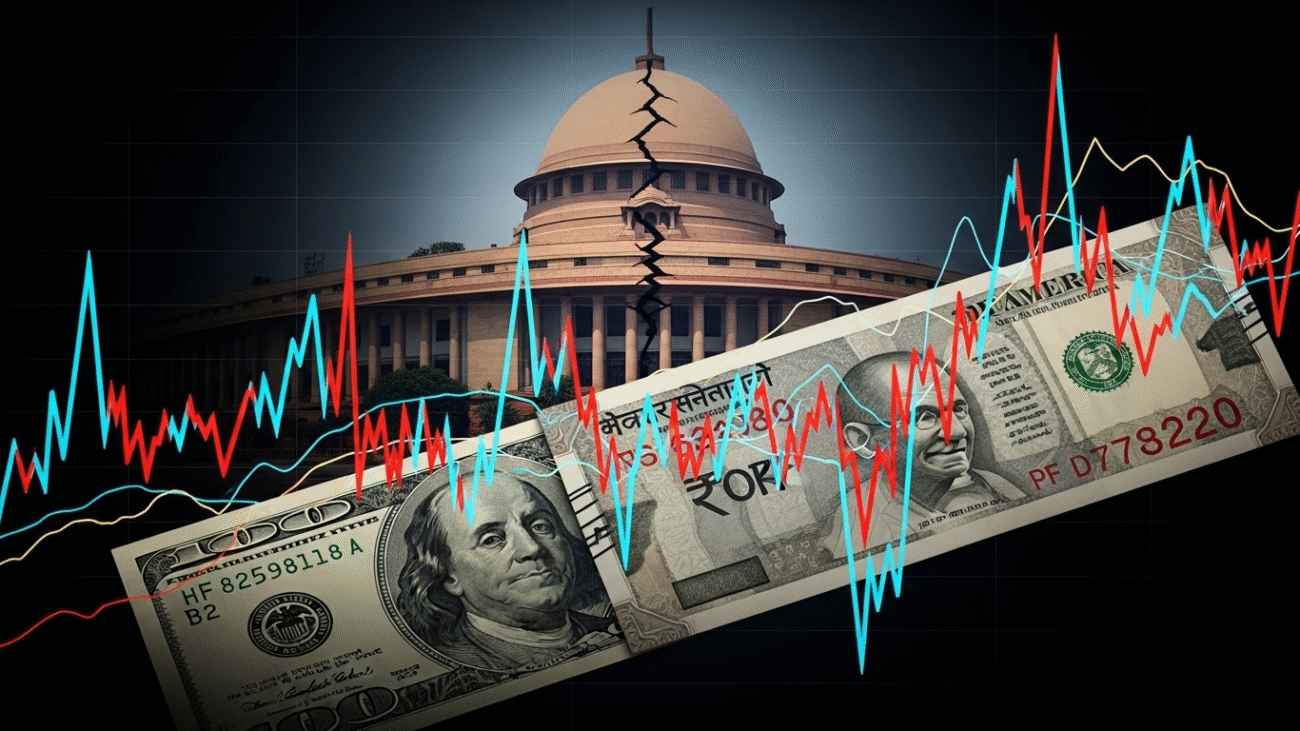

The week of October 12–18, 2025, plunged global finance and forex markets into a fresh wave of volatility, primarily driven by the alarming re-emergence of the US debt ceiling crisis. This political standoff overshadowed central bank statements, causing the US Dollar (USD) to become highly reactive. Meanwhile, the Indian Rupee (INR) demonstrated remarkable resilience, defying significant headwinds through a combination of robust economic data and continued, strategic intervention by the Reserve Bank of India (RBI).

1. The Dire US Debt Ceiling Crisis: A Looming Fiscal Cliff

The most critical financial news dominating headlines this week was the escalating brinkmanship in Washington D.C. over the US federal debt ceiling. The Treasury Department announced on October 15 that the “X-date”—when the U.S. would officially run out of cash to pay its bills—could arrive as early as October 25, 2025.

Political Gridlock and Market Panic

- The Stalemate: House Republicans and the White House remained locked in a fierce political battle. Republicans demanded substantial spending cuts as a precondition for raising the debt limit, while the Biden administration insisted on a “clean” increase without concessions.

- The Unthinkable Scenario: Fears of a technical default, though historically averted, sent tremors through global markets. A default would have catastrophic consequences, potentially triggering a worldwide financial crisis, a collapse in confidence in US Treasury bonds (the bedrock of global finance), and a sharp recession.

- Forex Impact: The immediate effect on the US Dollar (USD) was palpable. While initially experiencing some safe-haven buying due to global uncertainty, the DXY quickly faced selling pressure as the “risk of default” became a tangible threat. Traders began unwinding long-USD positions, leading to erratic movements against major currencies. The uncertainty created a demand for hedging instruments, with USD volatility futures spiking.

2. Indian Rupee’s Unstoppable Resilience: Data & RBI Power

Against the backdrop of global turbulence, the Indian Rupee (INR) showcased impressive strength, largely attributable to robust domestic economic data and a relentless intervention strategy by the Reserve Bank of India (RBI).

Unexpected Growth and Inflation Data

- Manufacturing Surge: Data released on October 16 showed that India’s Manufacturing Purchasing Managers’ Index (PMI) unexpectedly surged to 57.8 in September (from 56.4 in August), far exceeding analyst expectations. This pointed to strong domestic demand and production, a positive signal for the economy.

- Contained Inflation: The latest Consumer Price Index (CPI) data, also released mid-week, showed inflation cooling slightly more than anticipated, settling at 4.8% year-on-year. While still above the RBI’s comfort zone, the moderation eased immediate pressure for rate hikes and supported a positive outlook for the Indian economy.

RBI’s Strategic Intervention Continues

The RBI continued its skillful management of the Rupee, particularly in the offshore Non-Deliverable Forwards (NDF) market.

- NDF Dominance: The central bank’s increased presence in the NDF segment over the past few weeks (as highlighted in our previous reports) has successfully curbed speculative attacks and prevented the Rupee from breaching critical psychological levels (e.g., beyond 88.00/$1). By actively managing offshore liquidity and sentiment, the RBI can stabilize the currency without significant depletion of its domestic foreign exchange reserves.

- “Neutral” Stance Reinforced: The combination of strong growth and moderating inflation reinforced the RBI’s current “neutral” monetary policy stance, making the INR a relatively stable asset in a volatile global environment. This stability is absolutely crucial for businesses like Shiv’s Assets Group, which rely on predictable currency movements for export/import operations and managing raw material costs.

3. Eurozone & Japan: Diverging Fortunes

The week also saw distinct movements in the Eurozone and Japan, reflecting their unique economic challenges.

- Eurozone: Growth Concerns Mount: The Euro (EUR) faced renewed pressure as preliminary Eurozone Q3 GDP growth data, released on October 17, came in softer than expected at 0.1%, raising fears of a technical recession. The European Central Bank (ECB) President Christine Lagarde, speaking at a forum in Frankfurt on October 18, reiterated that while inflation was moderating, the growth outlook remained fragile, keeping the prospect of future rate cuts on the table. This dovish sentiment weighed on the EUR, especially against the stronger USD (prior to the debt ceiling fears).

- Japan: Yen Continues Slide, BoJ Stays Pat: The Japanese Yen (JPY) resumed its downward trajectory, slipping towards 153.00/$1, as the Bank of Japan (BoJ) Governor Kazuo Ueda firmly ruled out any immediate shifts in monetary policy. Despite growing calls for intervention, Ueda maintained that the BoJ would stick to its ultra-loose monetary policy until sustainable wage growth and inflation were firmly established. This widening interest rate differential with the US and Europe continued to exert downward pressure on the JPY.

4. Commodity Impact: Gold’s Safe Haven Appeal

In response to the US debt ceiling crisis, Gold (XAU/USD) saw a significant surge, affirming its status as the ultimate safe-haven asset. Prices climbed towards $2,050 per ounce by the end of the week, as investors sought refuge from potential market turmoil. This upward movement highlights the market’s deep apprehension about the US fiscal situation.

Source Link

Add a Comment