Container Freight Rates Up as India Spends $1.5B on Port Upgrades: 4 Key Shifts

The logistics and shipping sector during the week of November 8-15, 2025, was defined by the volatility of container freight rates on major global lanes and India’s accelerating port infrastructure agenda. While carriers continued their deliberate strategy of capacity control to push up rates, India simultaneously showcased massive investment, aimed at improving efficiency and global competitiveness for exporters like those using The Exporter Hub.

1. 📉 Global Container Freight Rates: The Carrier Capacity War

The expected post-peak-season softening of container spot rates was temporarily reversed on some lanes, only to resume its downward pressure, revealing a complex market dictated more by carrier strategy than organic demand.

-

Rate Divergence: Spot rates showed a clear divergence this week:

-

Transpacific (Asia to US): Rates resumed their downward trajectory. The brief surge from the November 1st General Rate Increases (GRIs) proved short-lived. Rates from Shanghai to New York (US East Coast) and Shanghai to Los Angeles (US West Coast) saw double-digit percentage drops as waning holiday season demand set in, and carriers increased capacity in anticipation of the previous week’s brief increase.

-

Asia to Europe: Rates demonstrated more resilience and even rose slightly on some key routes. Carriers are actively attempting to push new Freight All Kinds (FAK) rates higher, effective mid-November, in an attempt to elevate spot prices ahead of the critical annual contract negotiation season.

-

-

The Underlying Driver: The central factor in this volatility is carrier capacity management. Despite global overcapacity, shipping lines are maintaining profitability by aggressively deploying blank sailings (cancelling scheduled voyages) and limiting capacity utilization to around 80-85%. This forces shippers to focus on securing space early rather than negotiating price, making this a “book-early or miss-the-window” month, especially out of congested North Asian ports.

-

Air Freight Surge: In contrast to the ocean market, air freight rates out of Asia-Pacific surged, led by a jump in China to US spot rates. This is driven by robust demand for high-value goods, particularly e-commerce and electronics exports related to the surge in AI-tech cargo.

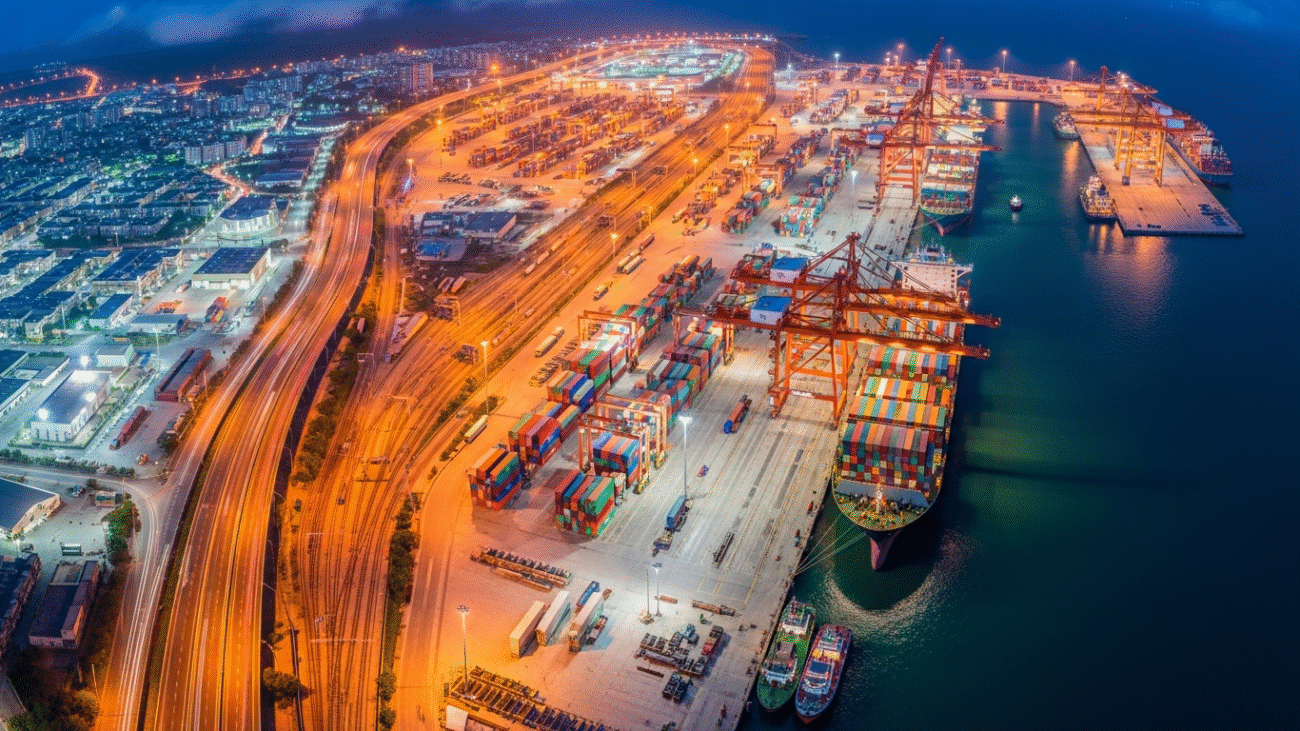

2. 🇮🇳 India’s Port Infrastructure Powerhouse

India’s commitment to bolstering its logistics backbone under the Maritime Amrit Kaal Vision 2047 was evident this week, offering long-term promise for enhanced export efficiency.

-

Mangalore Port Mega-Boost: The Union Minister of Ports, Shipping and Waterways inaugurated 16 key infrastructure projects and 113 corporate social responsibility (CSR) initiatives collectively valued at ₹1,500 crore at the New Mangalore Port Authority (NMPA). The NMPA, which is celebrating its Golden Jubilee, aims to boost its cargo handling capacity to 100 million tonnes by 2047 and achieve full carbon neutrality. The development includes the first 150-bed multi-specialty hospital among India’s major ports under a PPP model.

-

New Logistics Hubs:

-

Vizhinjam Port Support: The Kerala government initiated proceedings to allocate five acres of land near the Vizhinjam Port to establish a logistics hub, including over 50,000 square feet of multi-user warehousing space and a Container Freight Station (CFS). The proximity (5.4km from the port gate) is crucial for efficient 40-foot container truck access.

-

Nagpur Multi-Modal Logistics Park (NMMLP): Fresh tenders were issued for the Nagpur Multi-Modal Logistics Park (NMMLP), a ₹660 crore project under the Gati Shakti programme. Despite earlier setbacks and litigation, four infrastructure players showed renewed interest, underlining the government’s push to transform central regions like Maharashtra into critical logistics hubs.

-

3. 🛑 US Regulatory Delays and Trade Barriers

The lingering impact of the US government shutdown continued to create regulatory logjams, directly affecting Indian exporters of specialized or high-tech goods.

-

Export License Suspension: Agencies responsible for dual-use and defense-related goods, such as the Bureau of Industry and Security (BIS) and the Directorate of Defense Trade Controls (DDTC), remain largely impacted. While essential functions continue, the processing of routine export license applications and other non-urgent regulatory services remains severely delayed or suspended.

-

CBP Functional: Crucially, Customs and Border Protection (CBP) officers are deemed “essential,” so physical cargo clearance and tariff collection at US ports remain fully operational. The disruption is primarily administrative and regulatory.

-

EU Policy Watch: On the European front, the Commission proposed new protective measures for the EU steel industry, including reducing tariff-free import quotas by 47% and doubling out-of-quota duties to 50%. This is a major development for the Indian steel and TMT bar industry, requiring close monitoring by exporters to Europe.

Source :tfgglobal.com

Add a Comment