Critical! 5 Major Shocks Hitting Global Logistics and Indian Shipping

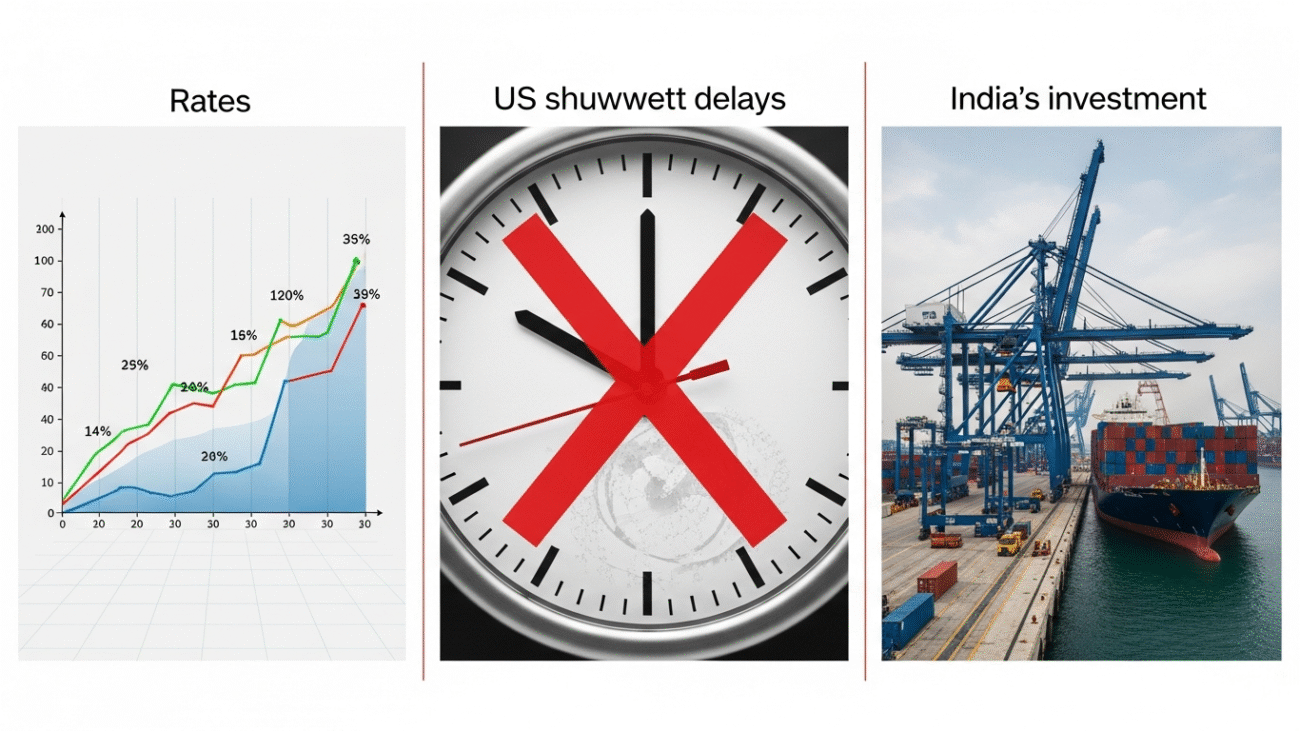

The first week of November 2025 in the Logistics & Shipping sector presented a complex and volatile picture. On one hand, global container freight rates saw a surprising upward correction, driven by carriers’ efforts to control capacity. On the other, the ongoing US government shutdown continued to severely disrupt critical export processes. For India, the focus remained on robust domestic growth and massive infrastructure investment aimed at solidifying its position as a global manufacturing hub.

1. 📈 Global Container Freight Rates Surge Unexpectedly

Despite a general expectation for softening rates due to overcapacity, global container indices defied the trend, driven by carrier tactics and seasonal adjustments.

- World Container Index (WCI) Jumps: Drewry’s World Container Index (WCI) saw a notable increase of 8% in the first week of November (as of November 6), marking the fourth straight week of price rises. The WCI reached $1,959 per 40ft container.

- Trans-Pacific Spikes: The sharpest increases were seen on the major Trans-Pacific routes, primarily due to General Rate Increases (GRIs) implemented by carriers on November 1st:

- Shanghai to Los Angeles (US West Coast): Increased by 9% to $2,647 per 40ft container.

- Shanghai to New York (US East Coast): Rose by 8% to $3,837 per 40ft container.

- Carrier Strategy: Carriers are aggressively pushing up spot rates through GRIs and blank sailings to counter excess capacity and strengthen their negotiating position ahead of the new annual contract season starting soon. However, Drewry’s long-term forecast suggests this momentum is short-lived, with rates expected to contract again as the supply-demand balance remains weak into the next quarter.

- India Trade Lane Rate Revision: In a direct move impacting Indian exporters, French carrier CMA CGM announced revised freight rates from Mediterranean ports to India and Pakistan, effective November 1, 2025, with rates varying significantly depending on the Black Sea, Adriatic, and West/East Mediterranean origins.

2. 🇺🇸 US Government Shutdown Causes Export Chaos

The prolonged US government shutdown continued to create significant regulatory bottlenecks, particularly for Indian exporters dealing in controlled goods or complex compliance scenarios.

- Export Licensing Freeze: Agencies crucial for exporting high-tech and dual-use goods have significantly curtailed operations:

- Bureau of Industry and Security (BIS): Services, including processing new export license applications and commodity classification requests, are suspended, except for those related to national security or the protection of US life and property.

- Directorate of Defense Trade Controls (DDTC): Similarly, the processing of defense-related export licenses and Commodity Jurisdiction (CJ) determinations is severely delayed.

- CBP Remains Operational: Fortunately, essential services at the border continue. Customs and Border Protection (CBP) officers are deemed “essential,” ensuring that cargo is still being cleared and tariffs are collected. The Automated Commercial Environment (ACE) system remains accessible for Electronic Export Information (EEI) submissions.

- Impact on Indian Exporters: Any Indian company exporting high-value, sensitive components that require a U.S. export license for onward shipment or for use by a U.S. partner is facing indefinite delays, forcing them to hold inventory or risk non-compliance.

3. 🇮🇳 Indian Infrastructure Investment and Growth

In stark contrast to the global volatility, India’s domestic logistics and infrastructure sector showed robust growth and massive future investment commitments, reinforcing its long-term potential.

- Record Investment in Ports: In a major boost to the maritime sector, the Housing and Urban Development Corporation (HUDCO) signed Memorandums of Understanding (MoUs) worth over ₹1.1 lakh crore with major ports (including Paradip, JNPA, Visakhapatnam, and Kolkata) to finance maritime and coastal infrastructure projects. This investment aligns with the Maritime Amrit Kaal Vision 2047, which aims to transform India into a global maritime hub.

- Shipbuilding and Green Shipping: India’s commitment to the “Make in India” initiative was visible in the shipbuilding sector. MoUs worth over ₹55,719 crore were signed in Maharashtra alone, focusing on new ship design, shipbuilding, and the assembly of battery systems for green ships. This includes plans to expand the Shipping Corporation of India (SCI) fleet to 216 vessels by 2047.

- Growing Cargo Volumes: Data showed positive growth at India’s major ports in the first half of FY26. Total cargo volume grew by 5.75%, led by strong growth in container traffic (up 13.9%) and imports of Fertilizers (up 108%). Smaller ports like Mormugao and Chennai also showed significant percentage growth, driven by commodity-specific demand and capacity upgrades.

- Inland Waterways Boost: The Inland Waterways Authority of India (IWAI) officially handed over the Kalughat Intermodal terminal to a Public-Private Partnership (PPP) operator, marking a key milestone in leveraging the country’s network of rivers for cargo transport.

Source Link: The source link for the global freight rate analysis and carrier strategy

Add a Comment