Table of Contents

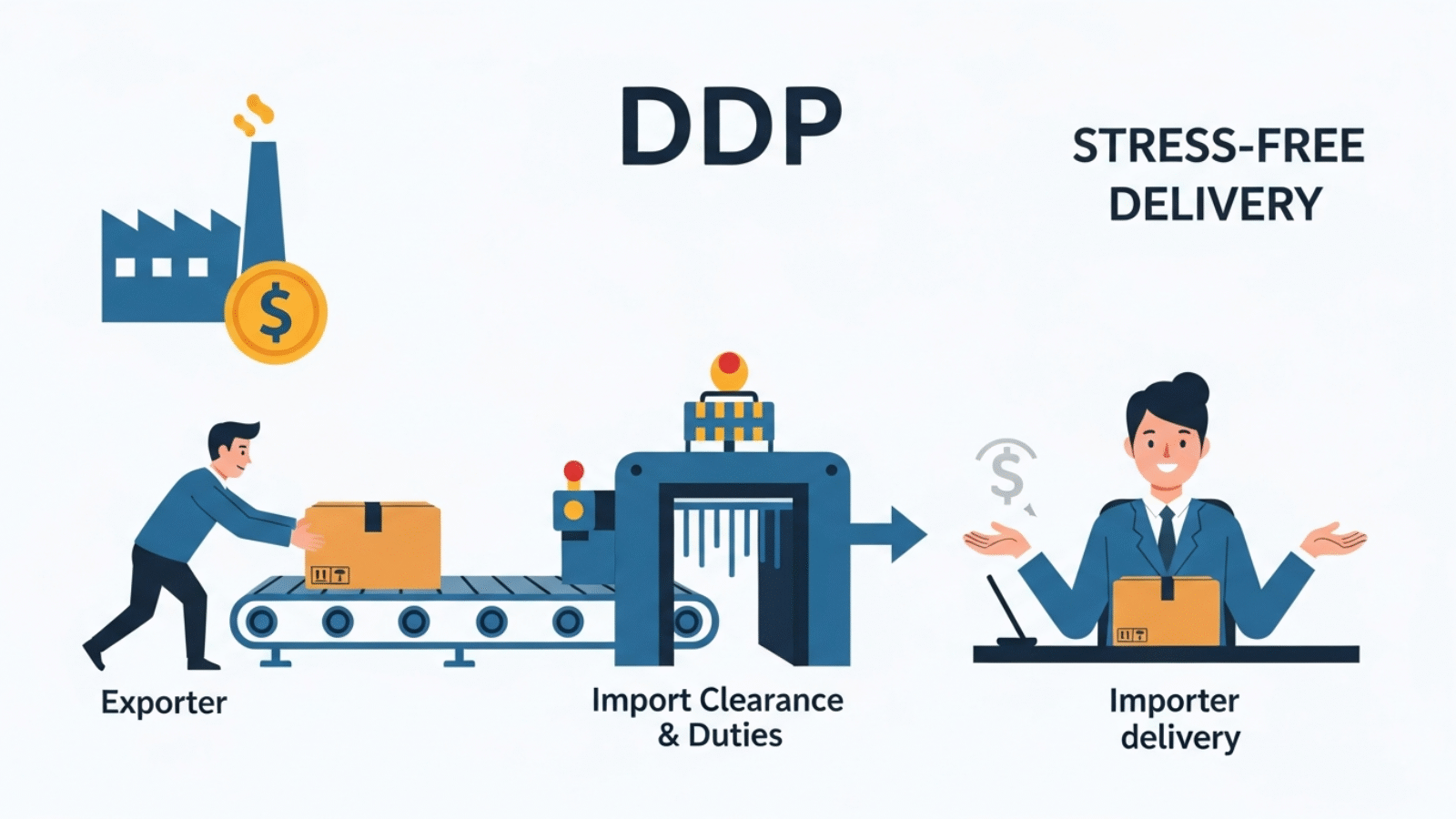

DDP Incoterm 2020 Introduction: The ‘Zero-Hassle’ Incoterm

In the world of international trade, DDP (Delivered Duty Paid) represents the maximum service a seller (exporter) can offer. It is the exact opposite of EXW (Ex Works).

Under DDP, the exporter bears virtually all costs and risks required to bring the goods to the final named destination, including paying for the import duties, taxes, and customs clearance fees in the buyer’s country. For importers on TheExporterHub.com, DDP is the simplest rule, offering a true ‘landed cost’ without any hidden or unexpected charges. This is particularly common in B2C e-commerce, but also used in B2B trade when the buyer demands absolute predictability or is new to importing.

1. What is DDP (Delivered Duty Paid) Incoterm 2020?

Under the DDP Incoterm, the seller fulfills their delivery obligation when the goods are:

- Placed at the buyer’s disposal, ready for unloading.

- At the named place of destination.

- Cleared for import (all duties, taxes, and fees paid).

Transfer of Cost and Risk

- Exporter’s Responsibility (Maximum): The seller is responsible for every cost and risk associated with the entire journey, including pre-carriage, export clearance, main carriage, insurance (though not mandatory, it’s necessary for the seller’s protection), and, most uniquely, Import Clearance, Duties, and Taxes (VAT/GST).

- Transfer Point: Both cost and risk transfer from the seller to the buyer at the named destination, precisely when the goods are ready for unloading and cleared for import.

The only obligation left to the buyer is usually the physical unloading of the cargo at their receiving point.

2. The Defining Factor: Import Duties and Taxes

The defining factor that separates DDP from DAP is the seller’s responsibility for import clearance:

- DAP: The buyer handles and pays all import duties, taxes, and clearance fees.

- DDP: The seller handles and pays all import duties, taxes (including VAT/GST), and clearance fees.

This places an enormous burden on the exporter, who must be fully aware of the customs regulations, duty rates, tax laws, and required licenses in the buyer’s country—a foreign jurisdiction. Failure to calculate these costs accurately can result in significant financial losses for the seller.

DDP and VAT/GST

A significant risk for the seller under DDP is the payment of Value Added Tax (VAT) or Goods and Services Tax (GST) in the buyer’s country.

- In many countries, VAT/GST paid at import can later be claimed back by the importing entity.

- Under DDP, the seller pays the VAT/GST. If the seller does not have a legal entity registered in the buyer’s country, they cannot claim this tax back, turning it into a straight cost.

- This VAT/GST cost can often be 15-25% of the goods’ value, making it a crucial calculation.

3. Exporter and Importer Responsibilities

DDP represents the pinnacle of service for the buyer and the maximum complexity for the seller.

| Responsibility | Exporter (Seller) under DDP | Importer (Buyer) under DDP |

| Delivery & Risk | Bears all risk and cost until goods are ready for unloading AND cleared for import. | Takes delivery and assumes risk from the point the goods are ready for unloading. |

| Export Clearance | Responsible for all export formalities. | Not responsible. |

| Import Clearance | MANDATORY: Must arrange and pay all duties, taxes (VAT/GST), and fees in the destination country. | Not responsible. |

| Unloading | Not responsible (Unless specified in the contract). | Responsible for arranging and paying for unloading the goods. |

| Insurance | No obligation to the buyer, but must maintain ‘all-risks’ insurance for their own protection until delivery is complete. | Not responsible. |

4. Conclusion: When to Use DDP

DDP is a powerful sales tool, especially for Indian exporters targeting new, small, or e-commerce buyers who demand a predictable, fixed price, or who are simply unwilling to deal with import customs complexity.

- Use DDP when:

- The seller has an expert international logistics network and deep knowledge of the destination country’s customs rules and tax laws.

- The buyer requires a truly fixed, ‘landed cost’ quotation upfront.

- The seller is targeting a market where competition dictates offering maximum convenience (e.g., e-commerce fulfillment).

However, DDP should only be undertaken by exporters with high confidence in their ability to manage foreign tax and duty regulations. For most transactions, DAP is the safer choice, as it passes the variable and unpredictable import tax burden back to the local entity best positioned to handle it—the buyer.

Add a Comment