Table of Contents

The world of international commerce might seem complex, filled with jargon like “tariffs” and “FTAs,” but at its heart, it’s simply nations deciding how easily they will buy and sell goods from one another.

India, now one of the world’s fastest-growing major economies, is in the middle of a massive trade transformation. As a student new to this topic, you can understand India’s strategy by focusing on three essential themes: The Tariff Tightrope, The Bridge Builders (FTAs), and The Export Boosters (Government Schemes).

Let’s break down these critical concepts using real, current examples.

1. The Tariff Tightrope: The Power of Trade Barriers

The most fundamental concept in trade is the tariff.

🌍 What is a Tariff?

A tariff is essentially a tax or duty that one country imposes on the goods and services imported from another country. Think of it as a gate fee.

- Goal: Tariffs are primarily used to make imported goods more expensive, protecting local (domestic) producers from foreign competition. They are also a significant source of government revenue.

🇺🇸 The US-India Tariff Negotiation Example

India’s relationship with the United States—its largest trading partner—perfectly illustrates the use of tariffs as a negotiating tool.

- The Conflict: In recent years, the US administration has imposed substantial tariffs, including a 50% duty on a wide range of Indian goods (like textiles, engineering goods, and footwear), citing geopolitical concerns and a perceived trade imbalance. This is a classic example of using a tariff as a penalty or leverage.

- The Impact: These high tariffs make Indian products less competitive for US buyers, hitting key Indian export sectors hard.

- The Negotiation: In response, India has engaged in high-stakes talks for a Bilateral Trade Agreement (BTA). The primary goal of this negotiation is to get the US to lower or remove those penalty tariffs, while India considers concessions on lowering its own tariffs for certain US products (like large motorcycles, almonds, or high-end whiskey).

The “tariff tightrope” shows that a tariff isn’t just a number; it is a policy instrument used to shape diplomatic and economic relationships.

2. The Bridge Builders: Forging Trade Agreements

While tariffs act as barriers, Trade Agreements are the bridges built to remove them.

🤝 What is a Trade Agreement?

A Trade Agreement is a pact between two or more countries aimed at promoting trade by establishing specific rules and, crucially, reducing or eliminating tariffs on most goods and services traded between them.

- Free Trade Agreement (FTA): A specific, comprehensive type of agreement that aims to remove nearly all tariff and non-tariff barriers, creating a vast, shared market.

🇦🇪 The India-UAE CEPA Example

India is currently pursuing an aggressive “bridge-building” strategy through FTAs to diversify its exports and reduce reliance on just a few partners.

- India-UAE Comprehensive Economic Partnership Agreement (CEPA): Signed in 2022, this was a massive step. The agreement immediately eliminated or reduced tariffs on over 80% of traded goods between India and the UAE.

- The Benefit: An Indian exporter selling jewellery or textiles to the UAE now faces zero or significantly lower tariffs, making their goods cheaper and instantly more competitive than the same goods from a non-FTA country. This is a game-changer for profitability.

- The EFTA Pact: More recently, India signed a landmark deal with the European Free Trade Association (EFTA) bloc (Switzerland, Norway, Iceland, Liechtenstein), securing a commitment of $100 billion in investment into India over 15 years, proving that these deals are about much more than just duties—they are about investment and job creation.

These agreements are foundational to India’s goal of expanding its global footprint by guaranteeing lower-cost access to huge, developed markets.

3. The Export Boosters: Government Schemes

Beyond negotiating with other countries, India’s government actively promotes its own exporters through targeted schemes. This is called Export Promotion.

🚀 What is Export Promotion?

Export Promotion involves government policies, financial incentives, and regulatory support designed to help domestic companies sell more goods and services abroad.

- Goal: To make Indian products more competitive globally by lowering the hidden costs of manufacturing and shipping.

💰 Key Schemes in India’s Trade Environment

Two schemes are central to India’s current export promotion strategy:

A. Remission of Duties and Taxes on Exported Products (RoDTEP)

When an Indian company manufactures goods, they pay several hidden domestic taxes and duties (like state taxes on fuel, electricity duty, etc.) that are not refunded under GST.

- How it Works: RoDTEP refunds these previously un-refunded taxes to the exporter. The refund is provided as a transferable electronic credit (e-scrip) based on a percentage of the exported product’s value.

- The Impact: By neutralizing these embedded costs, RoDTEP ensures that “taxes are not exported,” making the final price of the Indian product more competitive in the global market.

B. Production Linked Incentive (PLI) Scheme

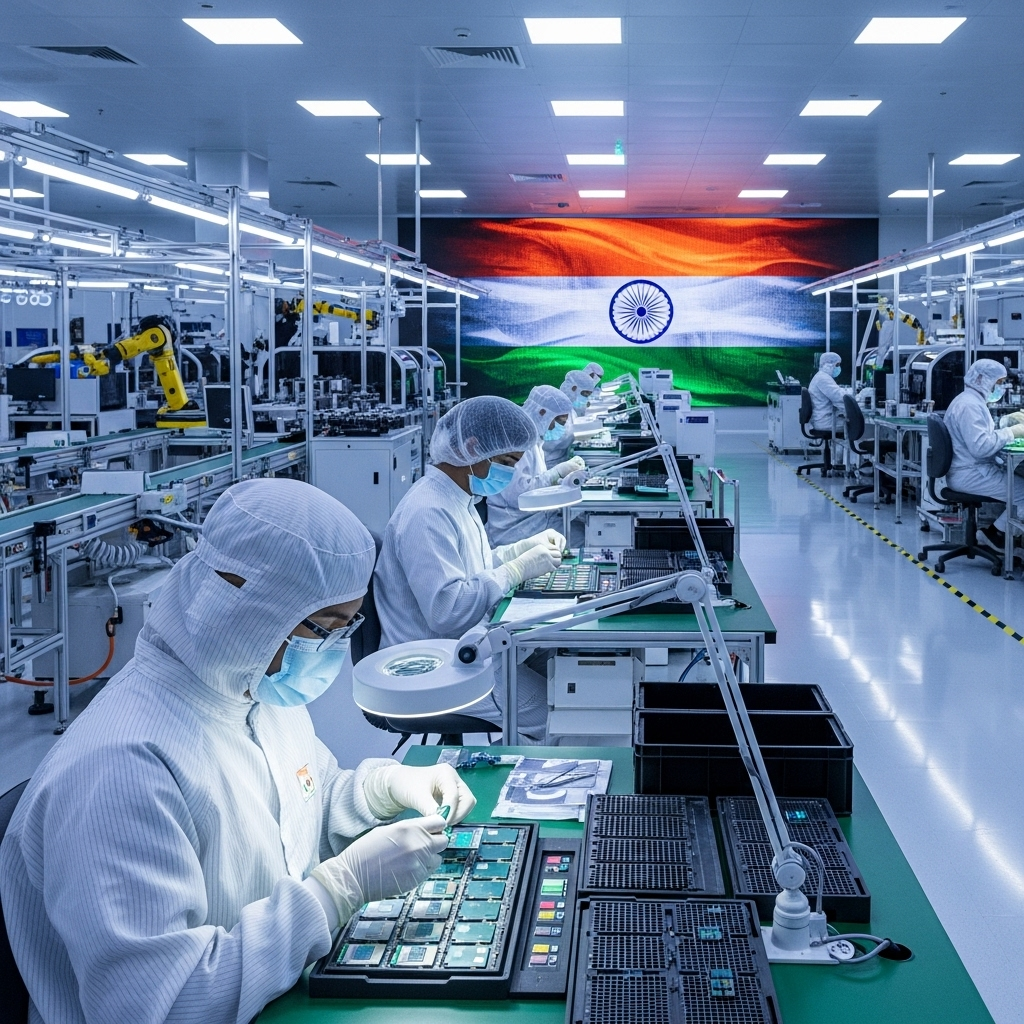

The PLI scheme is a powerful tool designed to attract large-scale investment and manufacturing.

- How it Works: The government offers financial incentives (up to 4-6% of the incremental sales) to companies that achieve specific production and sales targets. This covers 14 key sectors, including electronics, pharmaceuticals, and automobiles.

- The Impact: This scheme has successfully convinced major global brands (like Apple’s suppliers) to move significant manufacturing operations to India, transforming the country into a global hub for high-tech items, such as smartphones, and dramatically increasing India’s high-value exports.

Conclusion: India’s Role in a Changing Global Market

India’s current trade environment is defined by this dynamic interplay: fighting for fair access via the Tariff Tightrope, securing long-term markets through Trade Agreements, and boosting domestic competitiveness with Export Promotion schemes.

For a student of commerce, understanding these three themes offers a clear view of how India is strategically navigating the global market chaos, transitioning from a reactive player to a proactive global production and sourcing base.