Table of Contents

DPU Incoterm 2020 Introduction: A New Standard for Delivery at Destination

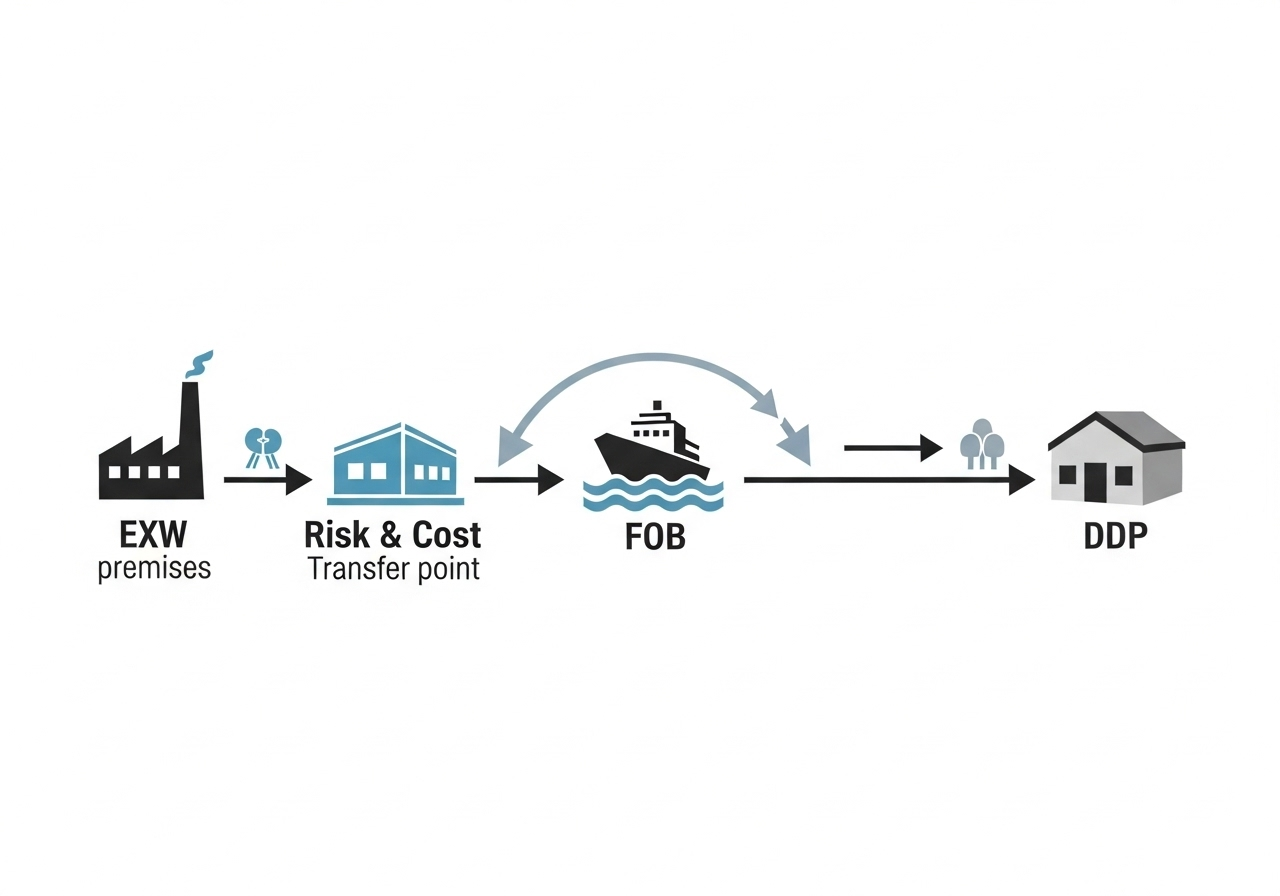

Incoterms® 2020 introduced DPU (Delivered at Place Unloaded) to replace the older DAT (Delivered at Terminal) rule. This change broadened the scope: the named place of destination can now be any agreed-upon location, not just a terminal (it could be a rail yard, a warehouse, or even the buyer’s factory floor).

DPU represents one of the most significant obligations for the seller (exporter) in the “D” group of Incoterms. Under DPU, the seller not only bears the cost and risk of bringing the goods all the way to the specified destination but also takes the critical step of unloading the goods at that location. For importers using TheExporterHub.com who lack the necessary equipment or manpower at a designated receiving location, DPU offers a complete, hassle-free logistics solution up to the point of import clearance.

1. What is DPU (Delivered at Place Unloaded) Incoterm 2020?

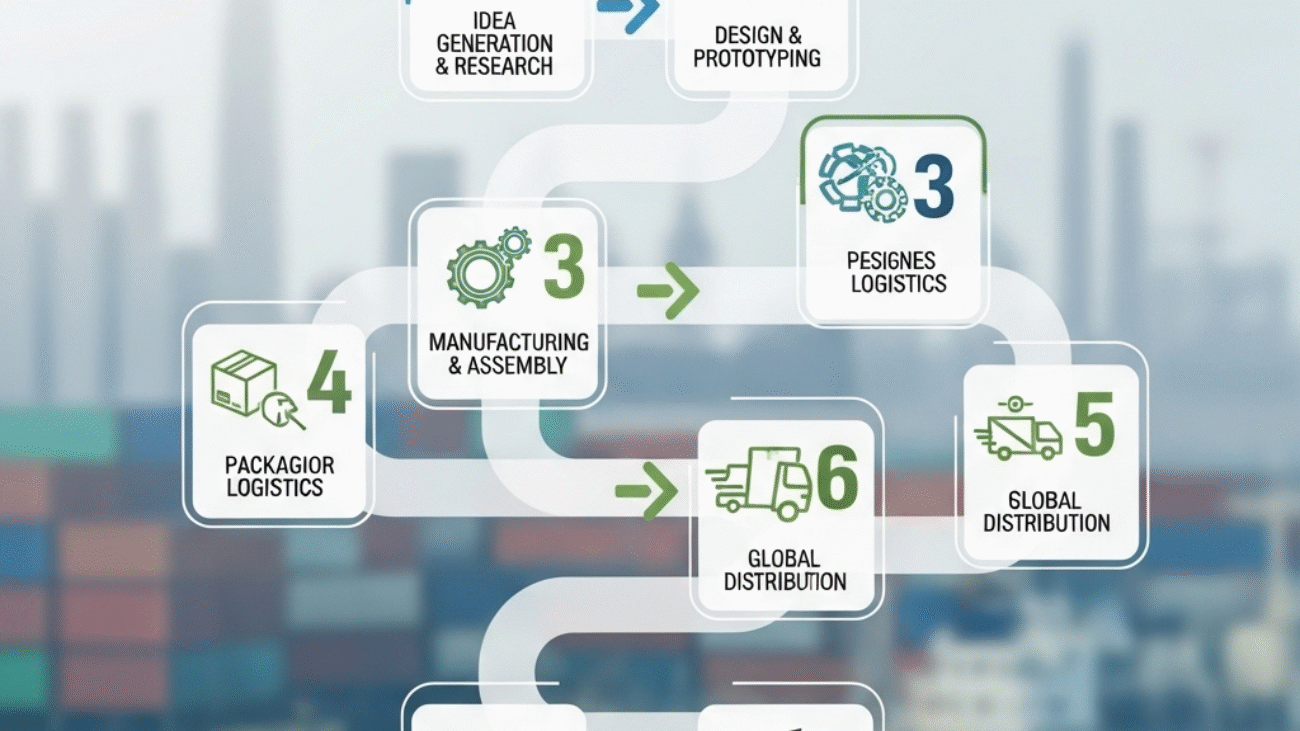

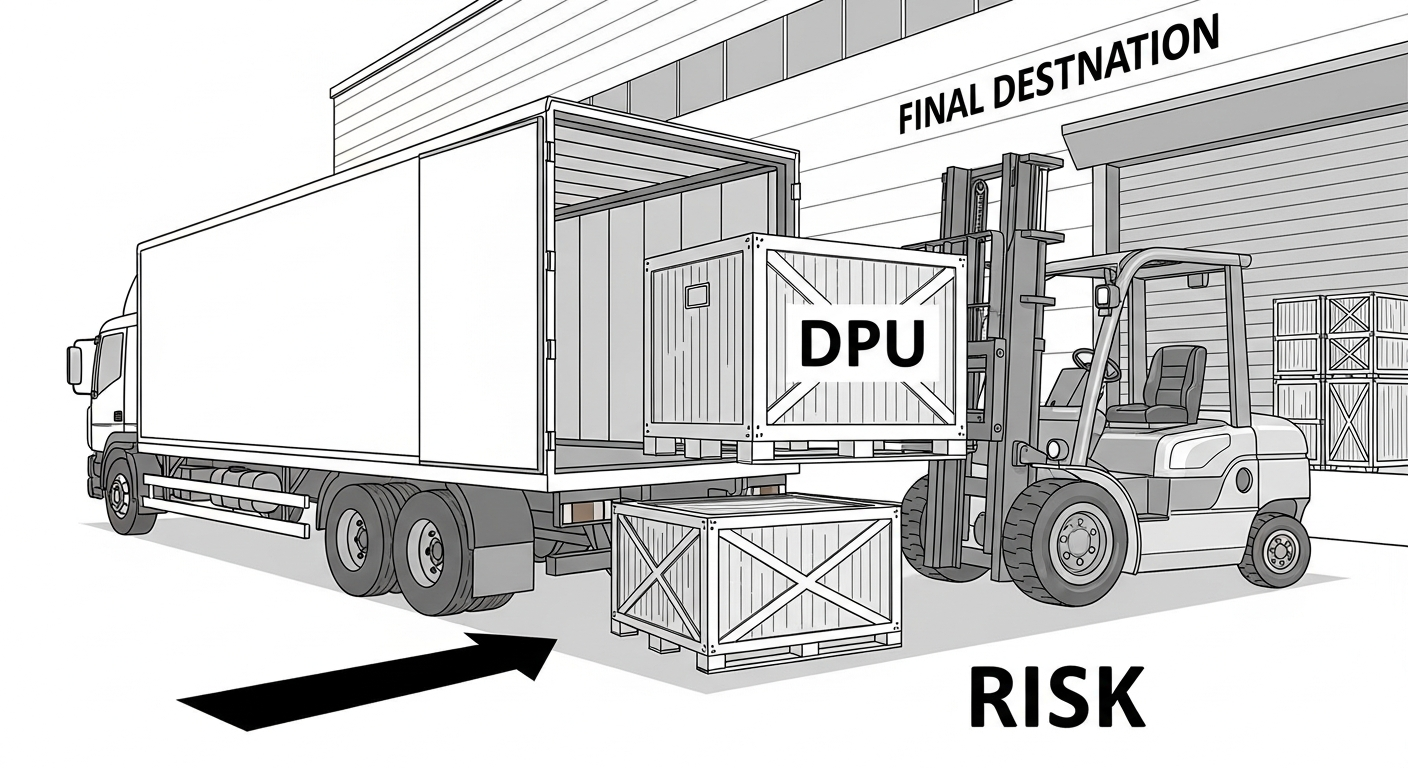

Under the DPU Incoterm, the seller (exporter) fulfills their obligation when the goods are:

- Placed at the disposal of the buyer.

- At the named place of destination.

- Unloaded from the arriving means of transport.

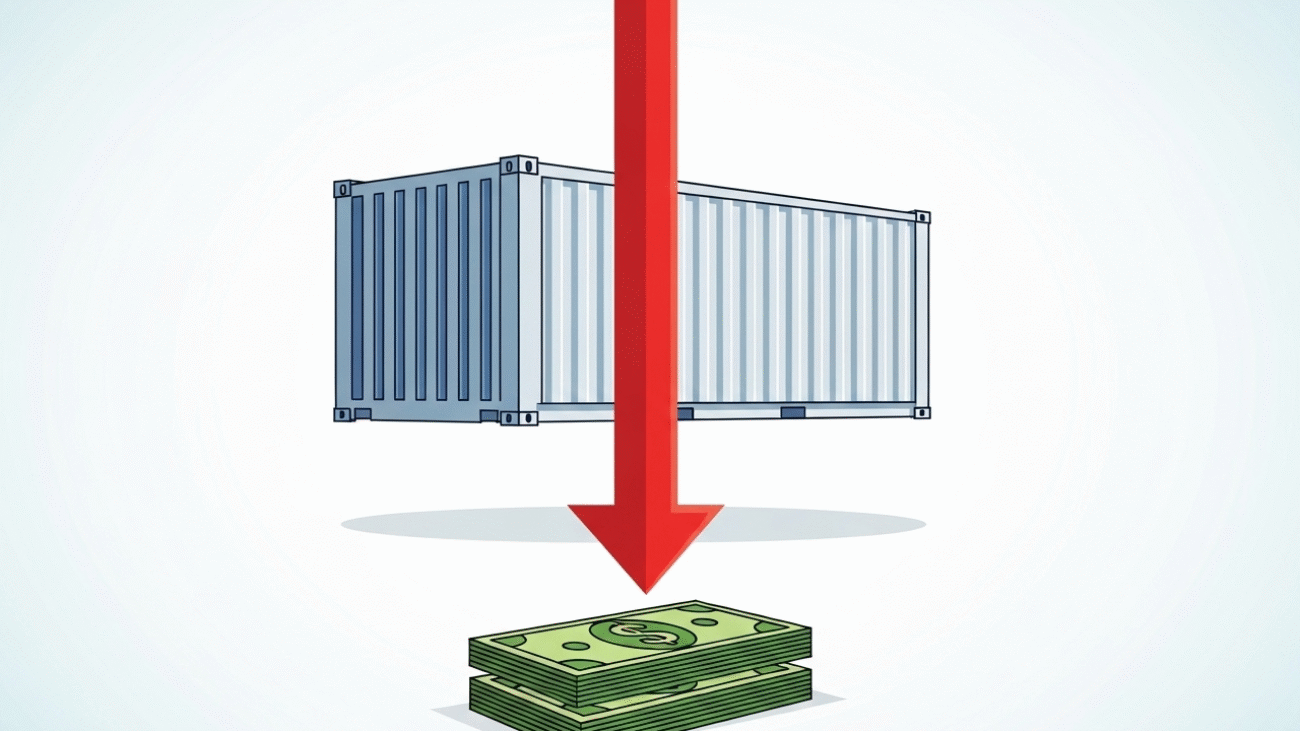

Transfer of Risk and Cost

- Cost and Risk Responsibility: Both the risk of loss/damage and the cost of transport remain with the seller until the goods are successfully unloaded at the named destination.

- A High-Risk Rule for Exporters: The exporter is responsible for the entire journey, including main carriage and any subsequent local transport within the destination country, up to the point of unloading. This is a massive responsibility and risk.

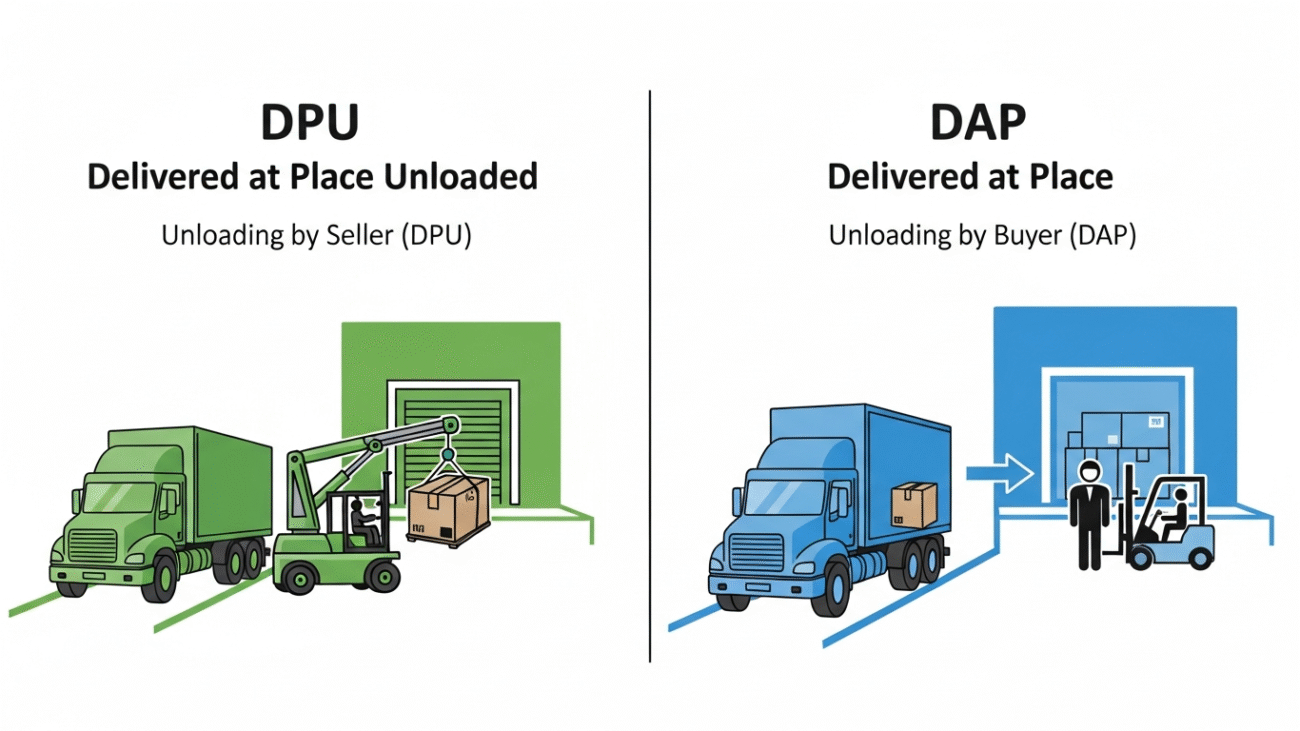

2. The Critical Difference: DPU vs. DAP

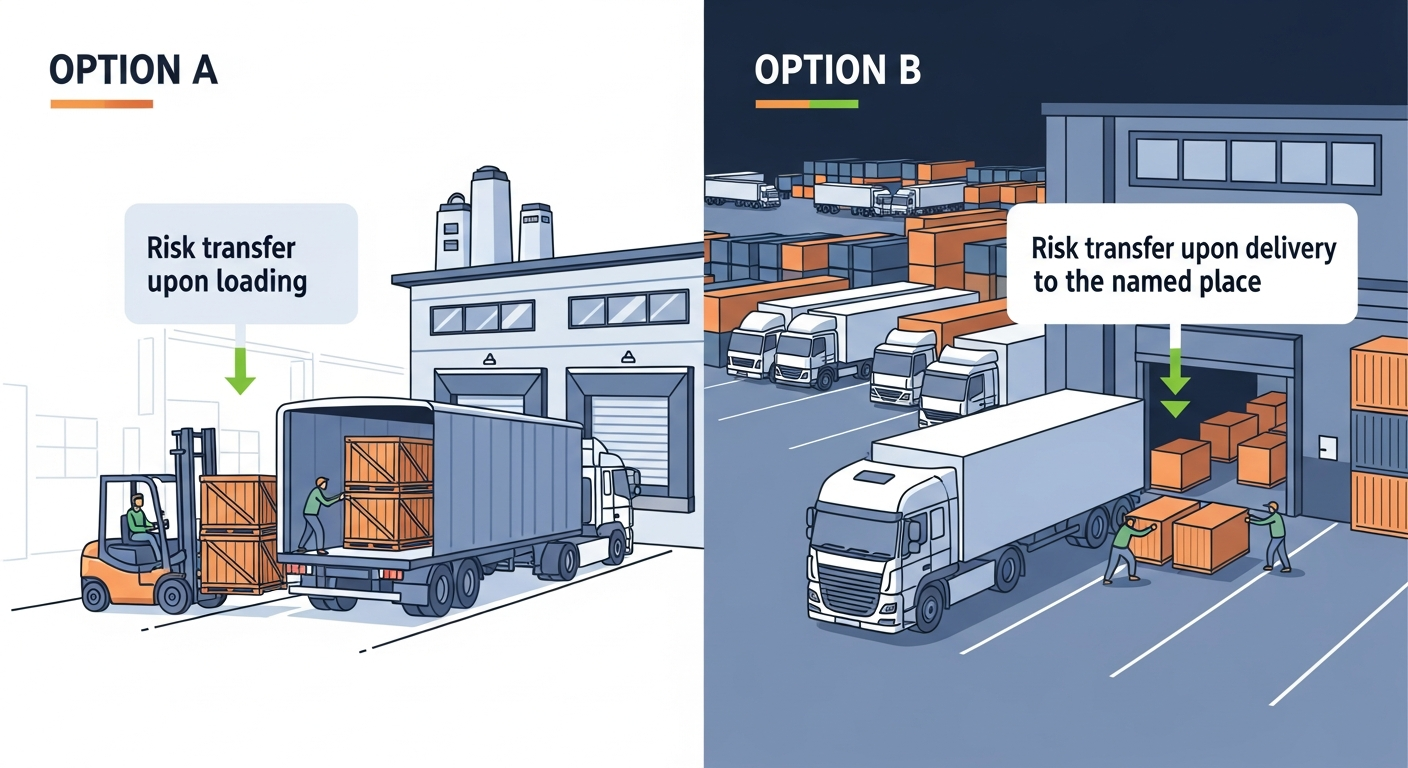

DPU is frequently confused with its similar counterpart, DAP (Delivered at Place). The distinction hinges entirely on the process of unloading:

| Feature | DPU (Delivered at Place Unloaded) | DAP (Delivered at Place) |

| Unloading Obligation | Exporter is responsible for unloading at the named destination. | Importer is responsible for unloading at the named destination. |

| Transfer of Risk | After the goods are unloaded. | Before the goods are unloaded (when ready for unloading). |

| Suitability | Best when the seller has control over local equipment (crane, forklift) or contracts with the final delivery carrier to include unloading. | Best when the importer has the appropriate equipment and manpower readily available at the destination. |

Crucial Advice for Exporters: If you agree to DPU, you must verify that unloading can be safely and legally performed at the named destination. Failure to do so means you have not completed your delivery obligation, and the risk remains yours.

3. Exporter and Importer Responsibilities

DPU requires maximum attention to detail from the exporter, making it a high-commitment Incoterm.

| Responsibility | Exporter (Seller) under DPU | Importer (Buyer) under DPU |

| Delivery & Risk | Bears all risk and cost until goods are unloaded at destination. | Takes delivery after unloading is complete. |

| Export Clearance | Responsible for all export formalities. | Not responsible. |

| Unloading | MANDATORY: Must arrange and pay for the unloading operation. | Not responsible. |

| Import Clearance | Not responsible. | Responsible for all import clearance, duties, taxes, and licenses. |

| Insurance | No obligation to the buyer, but the seller should maintain ‘all-risks’ insurance to cover their own risk during the entire transit, up to and including unloading. | Not responsible, but should consider contingency insurance. |

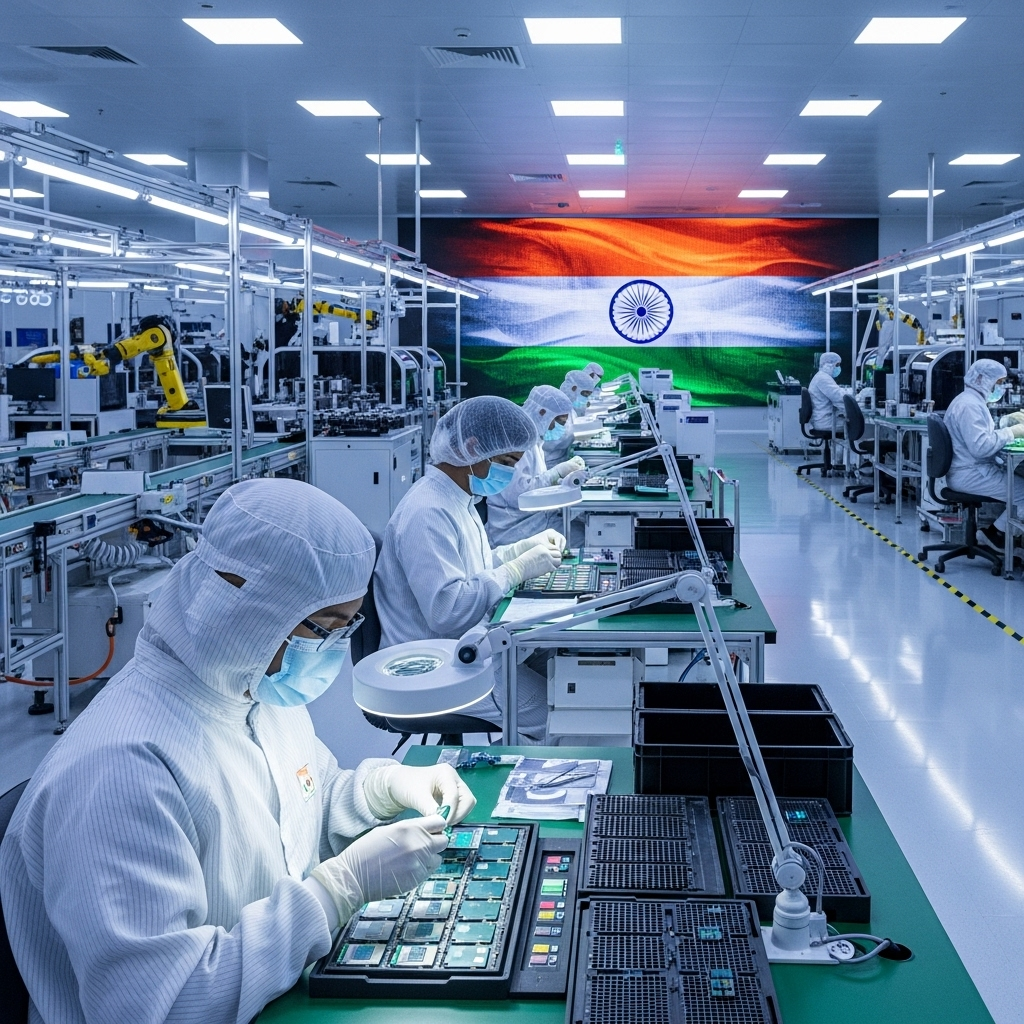

4. Practical Considerations for Indian Exporters

For Indian exporters of building materials (like Shiv’s Assets Group’s AAC Blocks) or heavy machinery, DPU is a double-edged sword:

- Marketing Advantage: Offering DPU is highly attractive to importers, as it offers a seamless, truly “delivered” price, simplifying the buyer’s supply chain management.

- Logistical Challenge: Managing the “last mile” unloading process in a foreign country (e.g., finding the right equipment, coordinating labor, and ensuring site safety) adds complexity. The Indian exporter must rely heavily on their international freight forwarder’s network to execute this final step flawlessly.

- Clarity in Documentation: The contract must clearly define the exact point of unloading (e.g., “Buyer’s warehouse, Dock 3, London”) to prevent disputes.

Conclusion: When to Use DPU

DPU is the ideal choice when the seller has significant control over the entire supply chain and wants to provide a complete delivery service. It is highly beneficial for the buyer who wants to receive the goods directly at their site, unloaded and ready for inspection.

However, due to the high risk and maximum responsibility it places on the exporter, DPU requires thorough due diligence. Ensure the named destination is suitable for unloading, the costs are accurately calculated, and your carrier is capable of executing the final, critical step. For most situations where the exporter does not want to handle unloading, DAP is the safer and more common Incoterm to use.