The penultimate week of 2025 has delivered a sharp wake-up call to global supply chain managers. The period from December 14 to December 20 was characterized by an unexpected, sharp upward correction in ocean freight spot rates, signaling that carriers are aggressively managing capacity ahead of the 2026 contract season. Furthermore, strategic divergences in routing between Asia and the West are creating a complex, multi-tiered service landscape for global importers and exporters.

Here is a deep-dive analysis of the critical logistics and shipping developments shaping global trade this week.

1. 📈 Ocean Freight Shock: Drewry Index Jumps 12% Ahead of 2026

Contrary to expectations of a year-end cooling period, global ocean spot rates experienced their most significant weekly surge since Q1 2025.

-

The Data: The benchmark Drewry World Container Index (WCI) increased by 12% this week, reaching $2,182 per 40ft container on December 18. This breaks a month-long trend of stagnation and puts rates significantly higher than the 2019 pre-pandemic average of $1,420.

-

Key Trades Affected: The surge was not uniform. The most dramatic increases were seen on the Shanghai to Rotterdam (+16%) and Shanghai to Los Angeles (+11%) headhaul routes.

-

Analysis for Global Shippers: This spike is a calculated move by major alliances. By implementing extensive “blank sailings” (canceling voyages) in December, carriers have artificially tightened space right before the pre-Chinese New Year rush (late January 2026). This strengthens their hand as they enter annual service contract negotiations with large global BCOs (Beneficial Cargo Owners), signaling that cheap fixed rates for 2026 will be hard to secure.

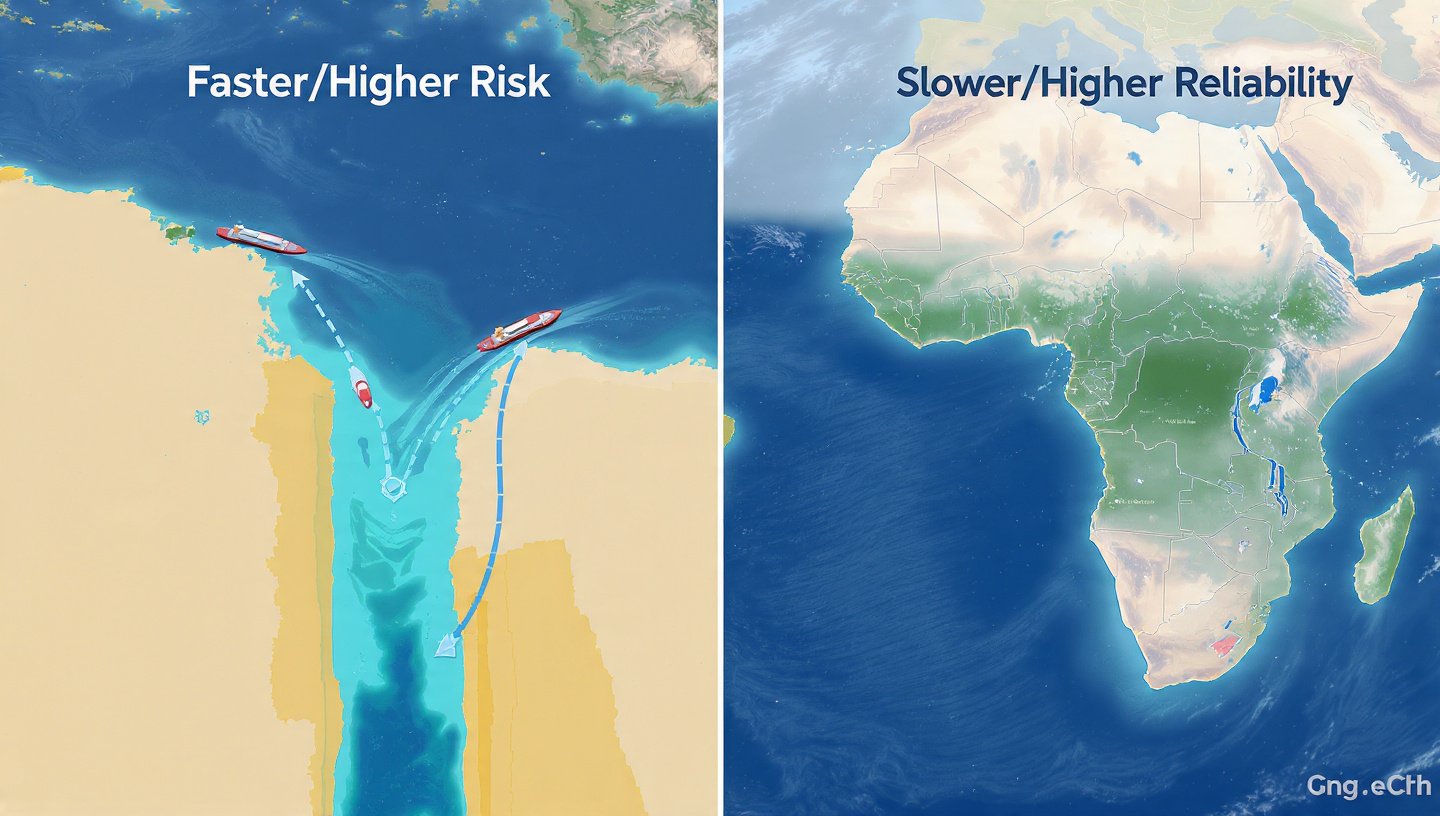

2. 🗺️ The Red Sea Split: CMA CGM Tests the Waters vs. The “Cape Route” Consensus

Nearly two years into the Red Sea security crisis, a significant strategic divergence emerged this week among top-tier carriers, complicating route planning for global shippers.

-

The Return: French carrier CMA CGM confirmed this week that its Indamex service (connecting the Indian Subcontinent to the US East Coast) has resumed transits via the Suez Canal, supported by naval escorts. They are also reportedly testing Suez routing for limited Asia-Europe loops.

-

The Divergence: In sharp contrast, giants like Maersk and Hapag-Lloyd (under the Gemini Cooperation starting Feb 2026) reiterated this week that they will stick to the Cape of Good Hope route around Africa for the foreseeable future, citing ongoing security risks.

-

Impact on Importers: This creates a two-tier market. Shippers can choose the “Suez route” for faster transit times (saving 10-14 days) but facing higher insurance premiums and potential disruption risk. Alternatively, they can choose the “Cape route” for higher reliability but longer lead times and higher bunker costs. Global supply chain planners must now actively decide between speed and certainty.

3. 🌿 Green Corridor Milestone: Rotterdam-Singapore Methanol Bunkering

The push for decarbonized shipping moved from theory to practice this week along one of the world’s busiest trade lanes.

-

The Event: The Maritime and Port Authority of Singapore (MPA) and the Port of Rotterdam announced the successful completion of the first end-to-end green methanol bunkering operation for a 16,000 TEU vessel operating on their joint “Green and Digital Shipping Corridor.”

-

Why it Matters: This proves the viability of alternative fuels on long-haul, high-volume trades for 2026.

-

Cost Implications: While a technical success, early data suggests the end-to-end logistics cost for goods moved on this “green sailing” carried a 15-20% premium compared to conventional heavy fuel oil voyages. Global brands with strict Scope 3 emissions targets are currently absorbing these costs, but it sets a benchmark for future green pricing mechanisms.

4. ✈️ Air Cargo Resiliance: High-Tech Sustains Q4 Rates

While ocean freight grabbed the headlines, the air cargo market demonstrated remarkable resilience in the final stretch of the peak season.

-

Market Dynamics: Despite the conclusion of the primary Black Friday/Cyber Monday rush, air freight rates out of Asia to North America and Europe remained flat at elevated levels this week, rather than dropping off.

-

The Driver: The sustained demand is being driven by late-cycle shipments of high-value consumer electronics, particularly AI-enabled devices released late in Q4 2025, which require rapid global distribution. This indicates that for time-sensitive global supply chains, air cargo capacity remains tight heading into the new year.

Source: Drewry Supply Chain Advisors – World Container Index Assessment (Dec 18, 2025)

Add a Comment