Table of Contents

CFR Incoterm 2020 Introduction: Balancing Service and Liability

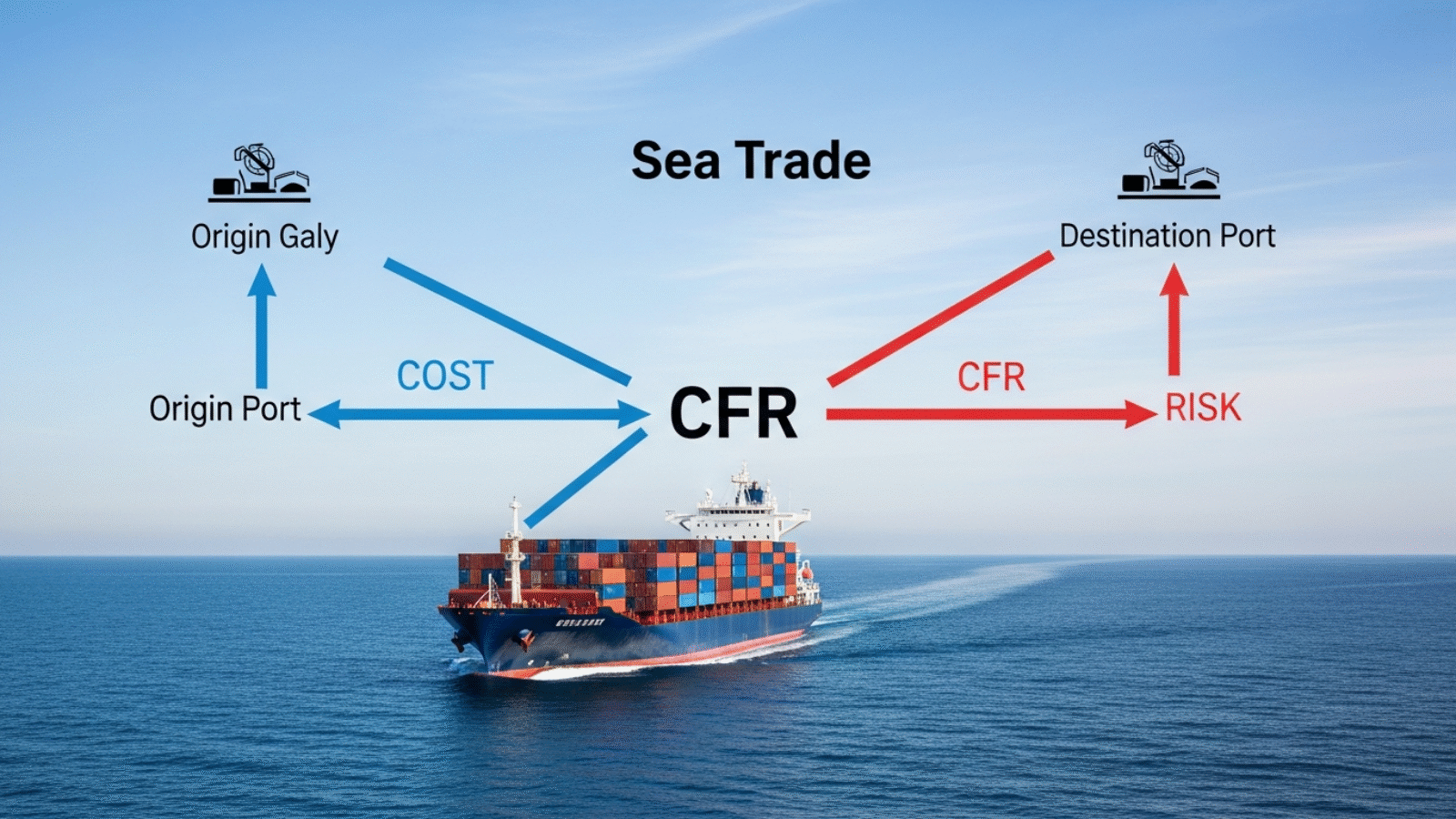

The CFR (Cost and Freight) Incoterm is a traditional sea-only rule that offers the importer (buyer) the convenience of prepaid freight up to the port of destination, while simultaneously placing the responsibility for transit risk squarely on the buyer much earlier in the journey.

CFR is widely used, particularly for non-containerized cargo, bulk commodities, and heavy industrial goods shipped via conventional ocean freight. It is a natural step up from FOB for exporters on platforms like TheExporterHub.com who want to offer a more inclusive, competitive price that covers the cost of international shipping.

1. What is CFR (Cost and Freight) Incoterm 2020?

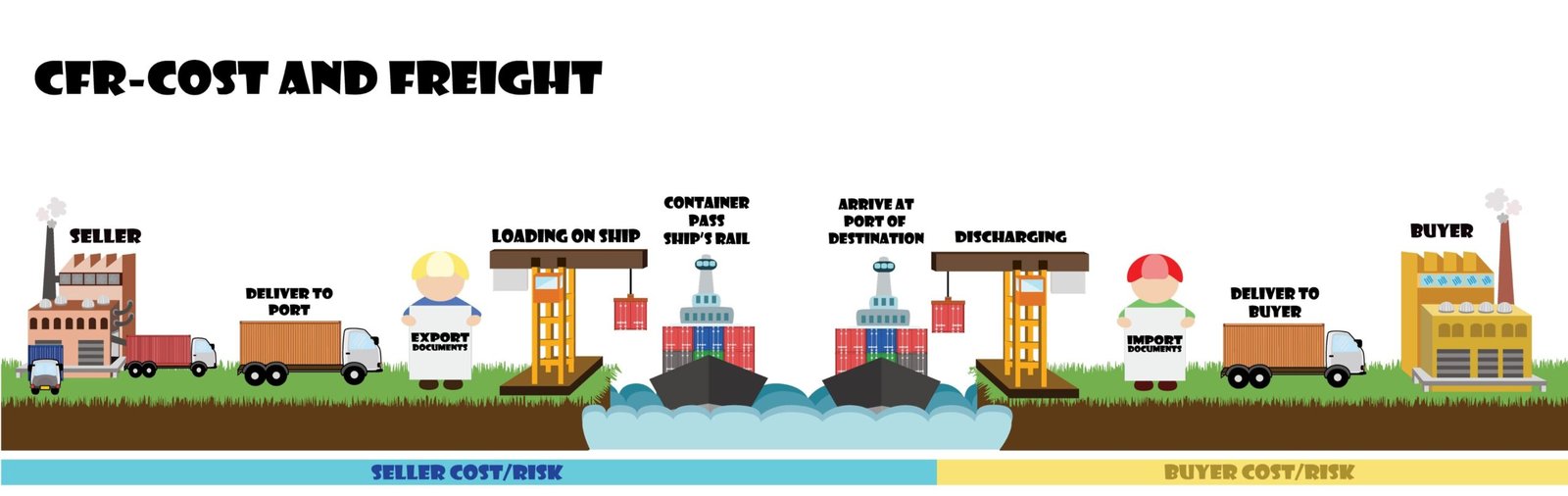

Under the CFR Incoterm, the seller (exporter) has two main responsibilities regarding the shipment:

- Cost Responsibility: The seller must contract and pay for the main carriage (freight) required to bring the goods to the named port of destination.

- Delivery/Risk Responsibility: The seller delivers the goods when they are placed on board the vessel at the port of shipment.

The Defining Feature: The Split

The core principle of CFR is the two-point transfer, similar to CPT:

- Risk Transfer: The risk of loss or damage transfers from the seller to the buyer when the goods are placed on board the vessel at the port of shipment (same as FOB).

- Cost Transfer: The seller pays for the freight up to the named port of destination.

This means that while the seller pays the hefty international shipping bill, the buyer owns the risk for the entire voyage and must purchase insurance to protect their cargo.

2. CFR vs. FOB: The Cost Distinction

The relationship between CFR and FOB is simple: CFR = FOB + Freight.

- FOB: The seller’s obligation ends when the goods are on board. The buyer pays the main freight.

- CFR: The seller’s obligation still ends when the goods are on board (for risk transfer), but the seller also pays the main freight to the destination port.

For the importer, the CFR price is simply a higher, more inclusive price than the FOB price, giving them a clear view of the total cost up to the destination port.

3. CFR vs. CIF: The Insurance Distinction

CFR and CIF (Cost, Insurance and Freight) are also closely related. The only difference is insurance:

- CFR: The seller pays for cost and freight, but insurance is not mandatory (the buyer must arrange it).

- CIF: The seller pays for cost and freight AND must procure mandatory minimum insurance cover for the buyer.

For buyers, if transit risk is a major concern, choosing CIF over CFR is generally advisable, as it ensures the cargo is protected.

4. Exporter and Importer Responsibilities

CFR places significant logistical responsibility on the seller, but requires the buyer to manage risk and terminal costs.

| Responsibility | Exporter (Seller) under CFR | Importer (Buyer) under CFR |

| Delivery & Risk | Bears risk and cost until goods are on board the vessel. | Assumes risk from the moment goods are on board until final delivery. |

| Export Clearance | Responsible for all export formalities. | Not responsible. |

| Main Carriage | Must arrange and pay for the carriage to the destination port. | Not responsible for arranging payment, but assumes risk during transit. |

| Unloading & Terminal Fees | Not responsible for unloading or fees at the destination port (unless these are included in the freight contract). | Typically responsible for destination terminal handling charges (THC), unloading, and onward transport. |

| Insurance | No obligation. | MANDATORY: Must purchase insurance to cover the goods for the entire voyage. |

| Import Clearance | Not responsible. | Responsible for all import formalities, duties, and taxes at the destination. |

5. Conclusion: When to Use CFR

CFR is an excellent choice when the exporter (seller) has superior access to competitive freight rates and wants to offer the importer a single, comprehensive price up to the port of arrival.

- Use CFR when:

- Shipping bulk cargo or non-containerized goods (as it is a sea-only rule).

- The seller has better bulk freight contracts and can pass the savings to the buyer.

- The buyer wants to control the insurance contract (perhaps they have a floating policy) but prefers the convenience of prepaid shipping.

However, like FOB, CFR should not be used for containerized cargo; the multimodal rule CPT should be used instead, as the risk transfer point (to the first carrier) better reflects container logistics.

Add a Comment