Table of Contents

FCA Incoterm 2020 Introduction: Why FCA is the Modern Incoterm of Choice

In the constantly evolving global trade landscape, the majority of goods are now shipped in containers. While the traditional FOB (Free On Board) rule remains popular, it is fundamentally designed for non-containerized bulk cargo. This has led industry experts and the International Chamber of Commerce (ICC) to champion FCA (Free Carrier) as the ideal, most flexible, and safest Incoterm for nearly all containerized shipments.

FCA strikes a perfect balance: it frees the importer from the complexities of export customs (unlike EXW), yet grants them control over the expensive international freight (unlike CIF/CFR). This guide provides a deep dive into the FCA Incoterm 2020, detailing its dual delivery options, clarifying the crucial transfer of risk, and explaining why it is the go-to rule for savvy importers and professional exporters on platforms like TheExporterHub.com.

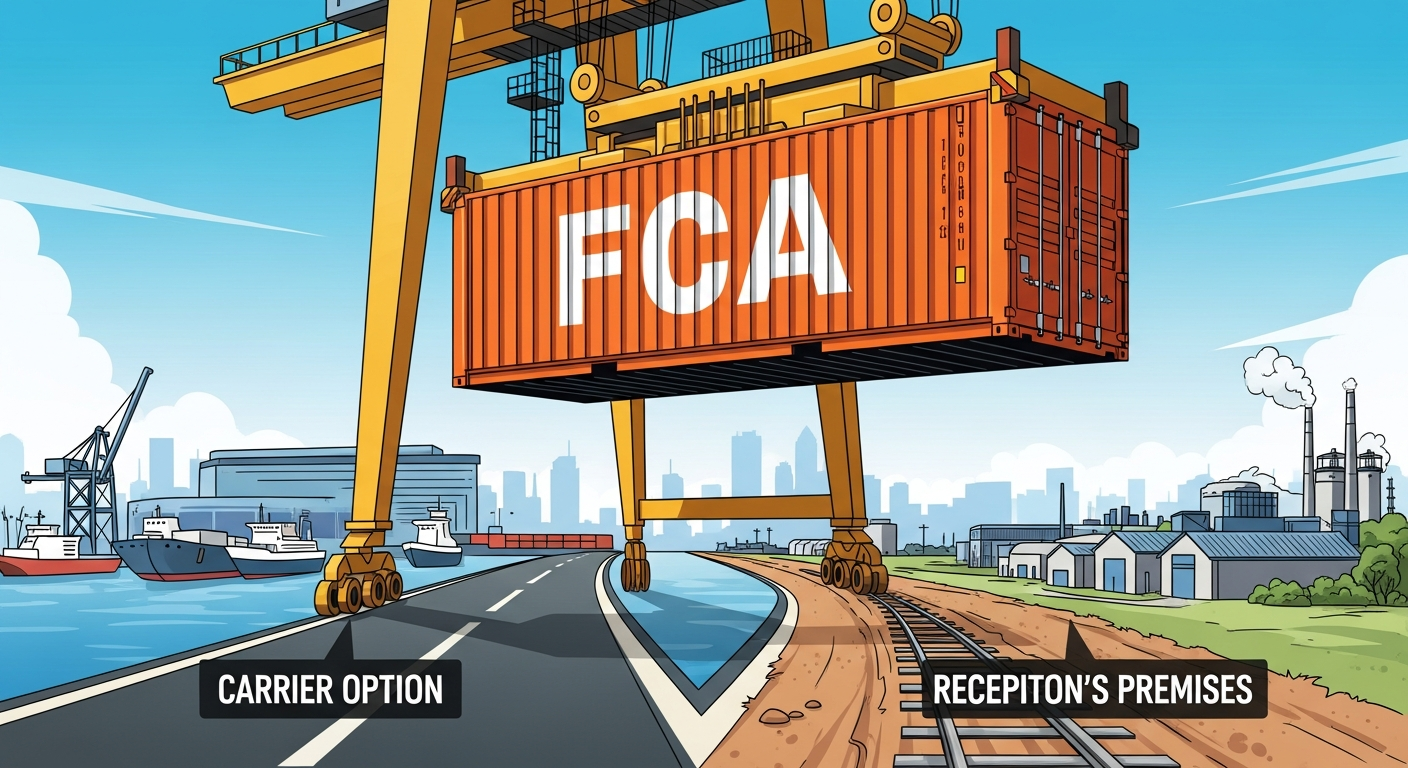

1. What is FCA (Free Carrier) Incoterm 2020?

Under the FCA Incoterm, the seller (exporter) delivers the goods to the buyer’s named carrier at a specific named place in the country of export.

Crucially, FCA provides two distinct delivery options:

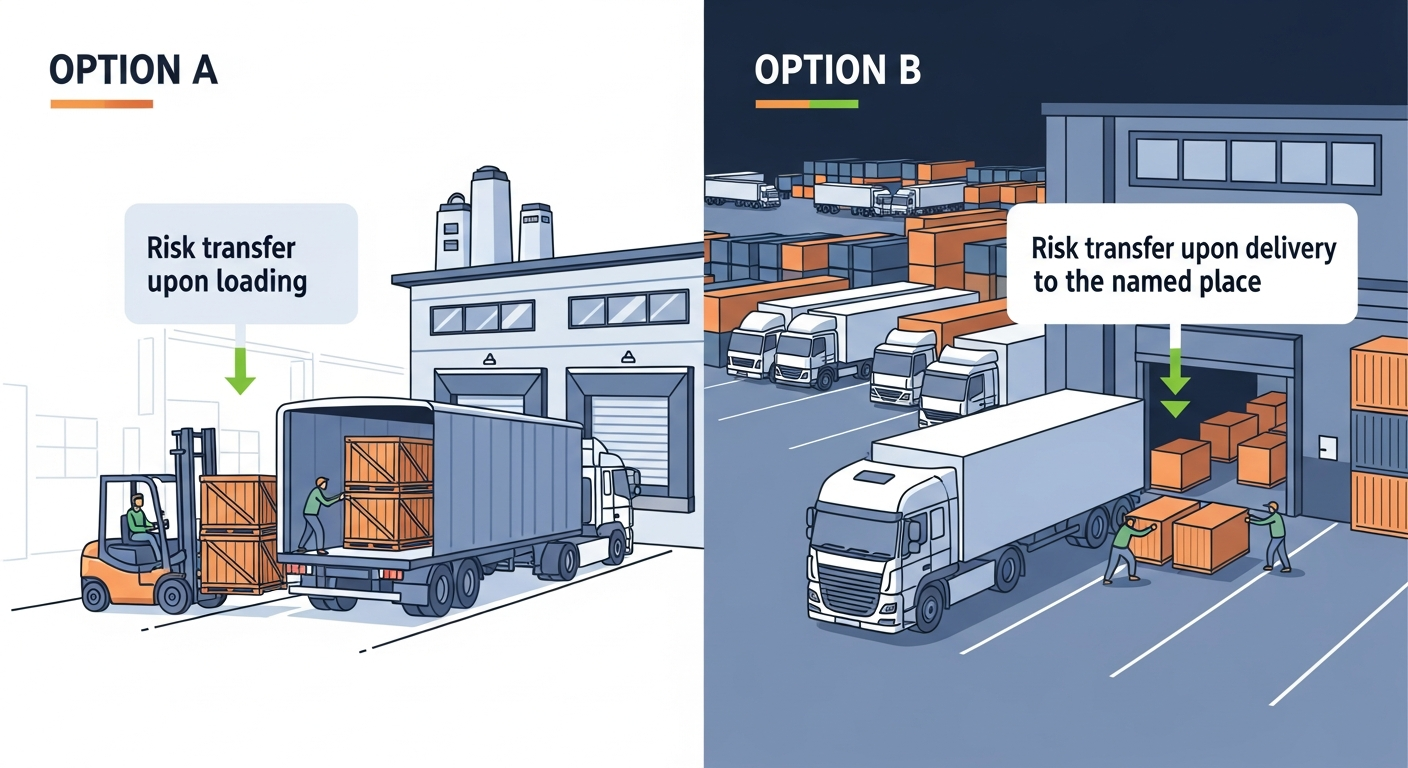

Option A: Seller’s Premises

- Delivery Point: The seller’s own warehouse or factory (similar to EXW).

- Transfer of Risk: Risk passes to the buyer once the goods are loaded onto the buyer’s transport vehicle (the truck/carrier picking up the goods) at the seller’s premises.

- Exporter’s Key Duty: The seller is responsible for loading the goods onto the buyer’s collecting vehicle, and, most importantly, for Export Customs Clearance.

Option B: Named Location (e.g., Forwarder’s Terminal or Port)

- Delivery Point: A place other than the seller’s premises, such as a freight forwarder’s warehouse, a rail terminal, or a container yard at a port.

- Transfer of Risk: Risk passes to the buyer once the goods are delivered to the named place and are ready for unloading (or, in the case of a carrier terminal, delivered into the carrier’s possession).

- Exporter’s Key Duty: The seller is responsible for the transport cost from their premises to the named location, and for Export Customs Clearance.

In both options, the buyer is responsible for the main carriage, insurance, and import clearance.

2. The Hidden Power of FCA: Export Clearance

The single most significant advantage of FCA over EXW is the responsibility for Export Customs Clearance.

- Under EXW: The buyer handles complex export clearance in the country of origin, which can be difficult without local knowledge (especially in India).

- Under FCA: The seller (exporter) is responsible for all export formalities, licenses, and duties required to get the goods cleared for leaving the country.

This small but vital difference makes FCA far safer for importers, as the exporter—who already has local knowledge and licensing (IEC, GSTIN)—is best placed to handle their country’s complex export procedures.

3. Why FCA is Superior to FOB for Containerized Cargo

FOB is designed for bulk goods (like oil or grain) that are loaded directly onto a ship. When a container is involved, the goods are often loaded days before the ship sails, inside a forwarder’s yard.

- FOB’s Flaw: Under FOB, the risk only transfers when the goods are placed “on board” the vessel. If a container is damaged while sitting in the port terminal awaiting shipment (a common scenario), the seller is technically still responsible, even though they lost control days ago.

- FCA’s Clarity: With FCA, risk transfers much earlier (either at the seller’s door or the forwarder’s terminal), which is when the seller actually loses control of the goods. This aligns the transfer of risk with the physical reality of container logistics.

Choosing FCA over FOB for container shipments provides clearer liability and prevents disputes over who owns the risk while the container is sitting in the congested port.

4. Key Benefits and Risks for Importers and Exporters

| Stakeholder | Benefits of Using FCA | Risks of Using FCA |

| Importer (Buyer) | Full Control: Chooses the main international carrier, securing better freight rates and controlling transit time. Risk Mitigation: The exporter handles export customs clearance. Clarity: Clear risk transfer point before the goods reach the port. | Cost Control: Responsible for all costs from delivery point onwards, including main carriage and insurance. |

| Exporter (Seller) | Risk Reduction: Risk passes early, usually before the goods enter a major, congested port terminal. Competitiveness: Can offer a service that is more user-friendly than EXW while avoiding the complexity of DDP/DAP. | Operational Complexity: Responsible for arranging local transport and ensuring export clearance is flawlessly executed before the buyer’s carrier arrives. |

5. Special Consideration: On-Board Bill of Lading

A major hurdle with FCA historically was that banks often require an “On-Board” Bill of Lading (B/L) for Letters of Credit (L/Cs). Since the seller’s responsibility ends before the ship loads the goods, they often couldn’t obtain this B/L.

The FCA 2020 Solution: The newest version allows the buyer (importer) to instruct their carrier to issue the On-Board B/L to the seller (exporter) after the goods are loaded. This key change makes FCA fully compatible with L/Cs, reinforcing its position as the premier container shipping term.

Conclusion: Making FCA Your Default Incoterm

For global trade, especially when importing from sophisticated export hubs like India, FCA (Free Carrier) offers the optimal balance of control, cost, and risk alignment. It simplifies the transaction for the importer by placing the burden of complex export procedures on the local expert (the seller), while giving the importer the ability to negotiate and control the expensive main freight contract.

If you are currently using EXW, consider upgrading to FCA. If you are using FOB for containerized cargo, FCA is the safer, more modern choice that reflects the actual realities of the global supply chain. This balance is key to building a secure, efficient, and profitable import business through platforms like TheExporterHub.com.

Add a Comment